EN

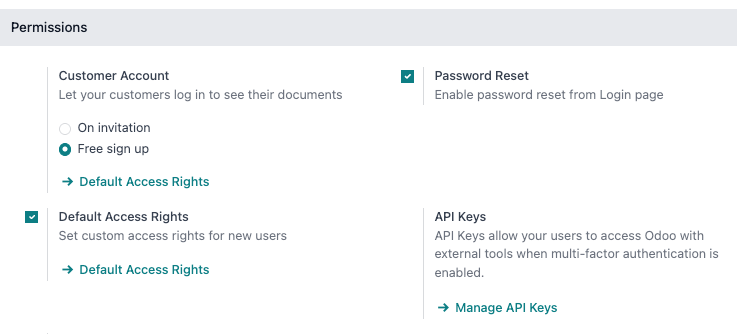

Odoo 18

User Docs

Discover our user guides and configuration tutorials per application.

- Odoo essentials

- Finance

- Sales

- Websites

- Supply Chain

- Human resources

- Marketing

- Services

- Productivity

- Studio

- General settings

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

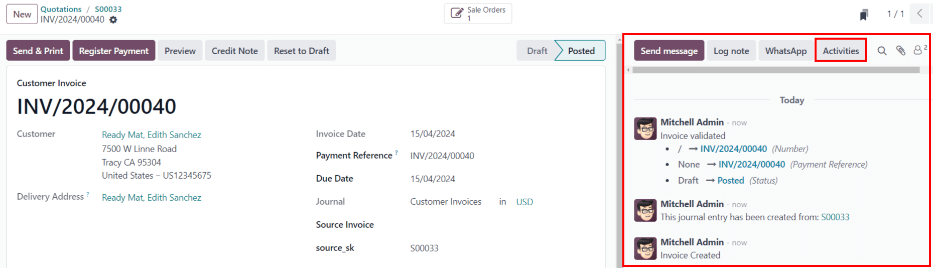

Activities

Activities are follow-up tasks tied to a record in an Odoo database.

The icon used to display activities varies, depending on the activity type:

- (clock) icon: the default activities icon.

- (phone) icon: a phone call is scheduled.

- (envelope) icon: an email is scheduled.

- (check) icon: a “to-do” is scheduled.

- (people) icon: a meeting is scheduled.

- (upload) icon: a document is scheduled to be uploaded.

- (request signature) icon: a signature request is scheduled.

Schedule activities

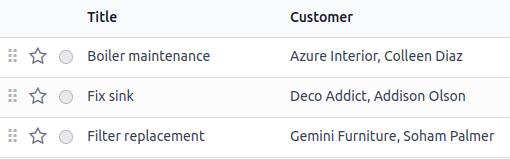

Activities can be scheduled on any page of the database that contains a chatter thread, Kanban view, list view, or activities view of an application.

Chatter

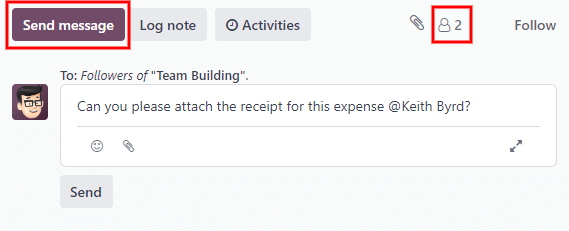

Activities can be created from the chatter on any record.

To schedule a new activity, click the Activities button, located at the top of the chatter. In the Schedule Activity pop-up window that appears, fill out the Schedule Activity form.

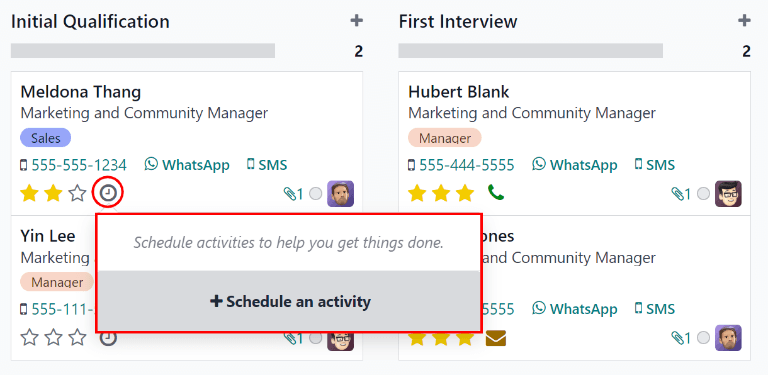

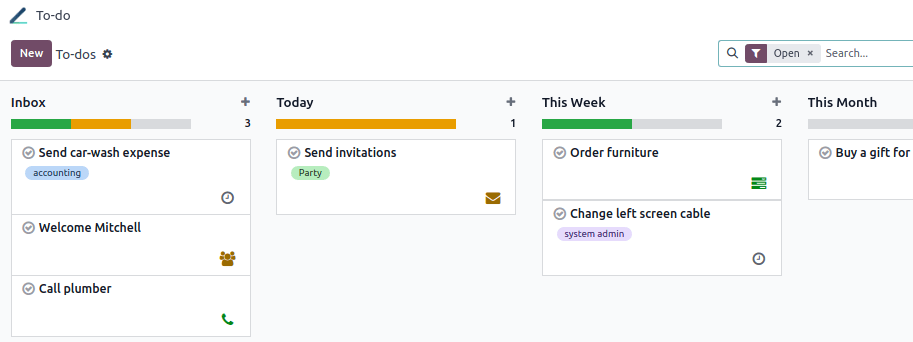

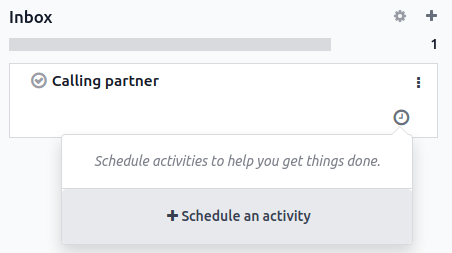

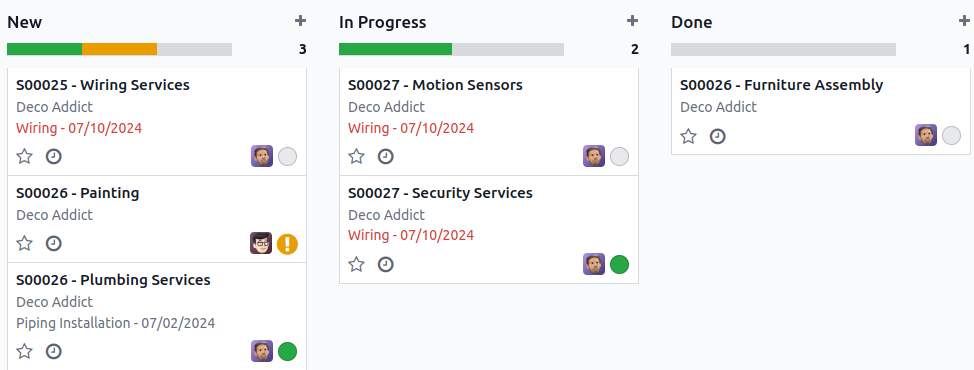

Kanban view

Activities can also be created from the (Kanban) view.

To do so, click on the (clock) icon located at the bottom of an individual record.

Click + Schedule An Activity, then proceed to fill out the Schedule Activity form.

Note

If a record already has a scheduled activity, the (clock) icon is replaced by the icon that represents the existing scheduled activity. Click on the activity type’s icon to schedule another activity.

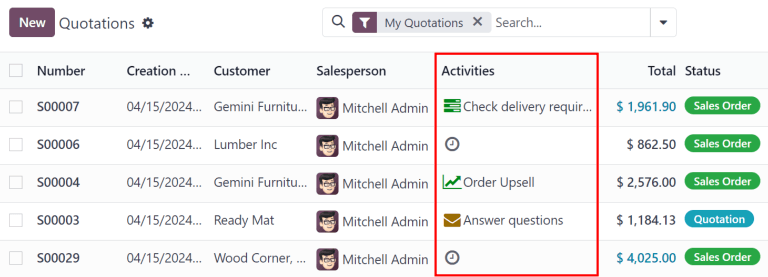

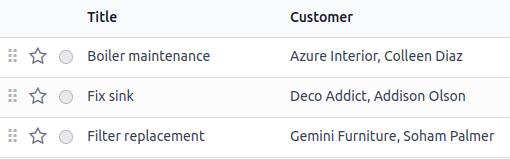

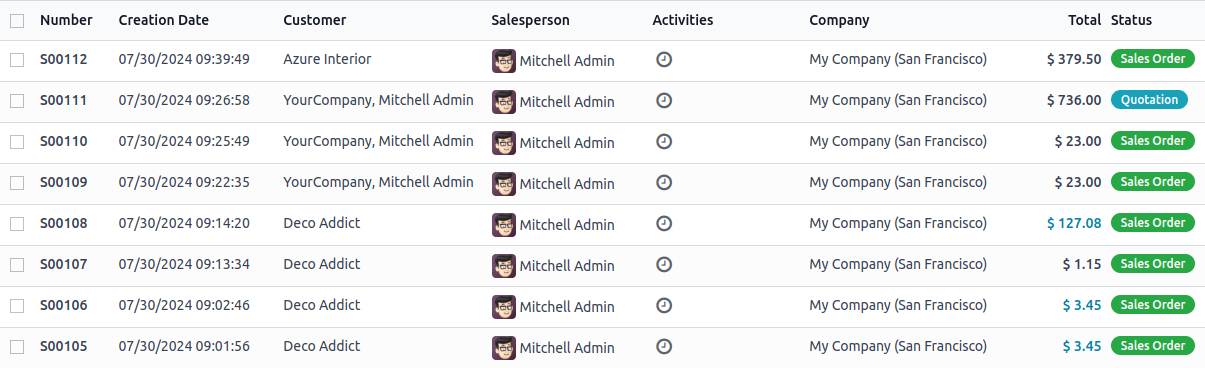

List view

Activities can also be created from a (list) view.

If the Activities column is hidden, reveal it using the (settings adjust) icon in the far-right of the top row.

Then, click on the (clock) icon for the record the activity is being added to, and click + Schedule an activity. Proceed to fill out the Schedule Activity form that appears.

Note

If a record already has a scheduled activity, the (clock) icon is replaced by the icon that represents the existing scheduled activity. Click on the activity type’s icon to schedule another activity.

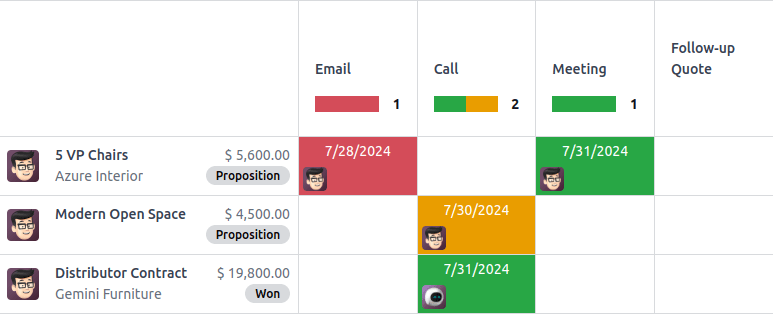

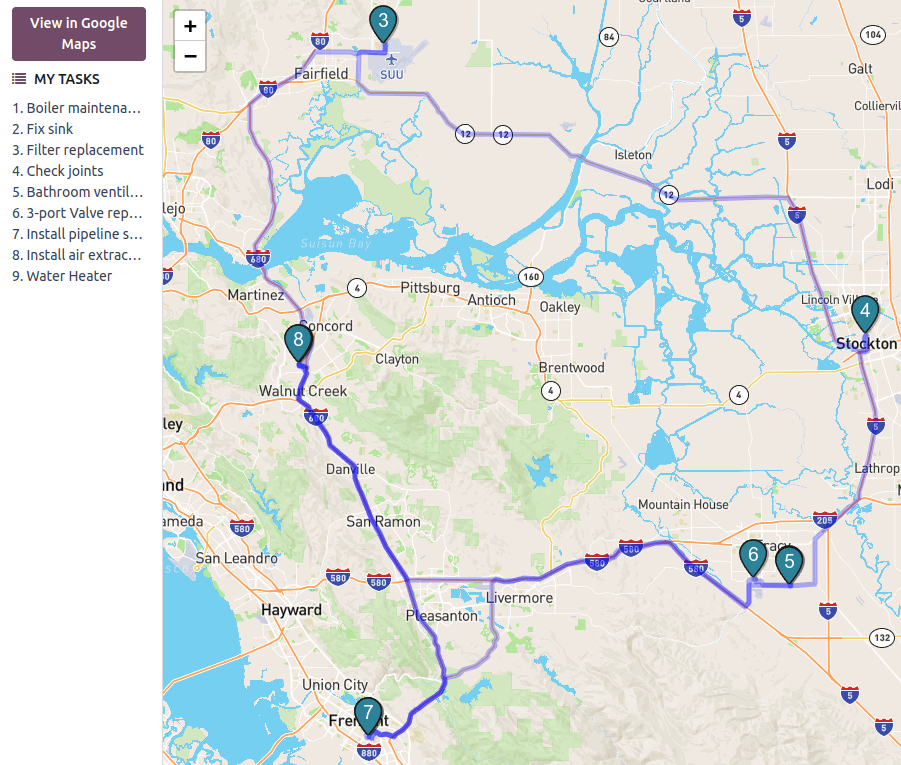

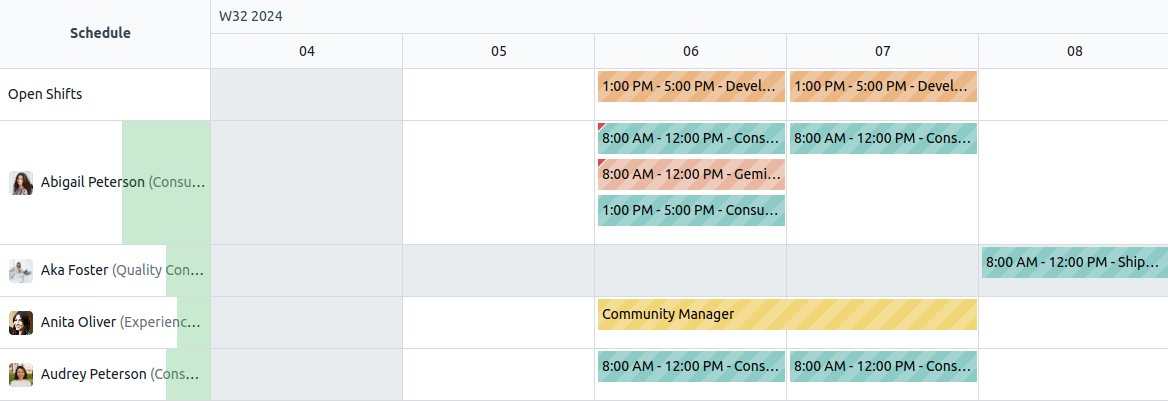

Activity view

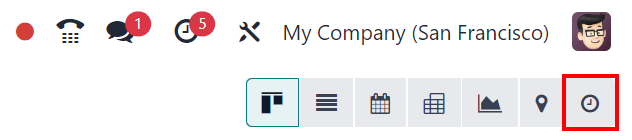

Most applications in Odoo have an Activity view available. If available, a (clock) icon is visible in the top-right corner of the main menu bar, amongst the other view option icons.

To open the activity view, click the (clock) icon.

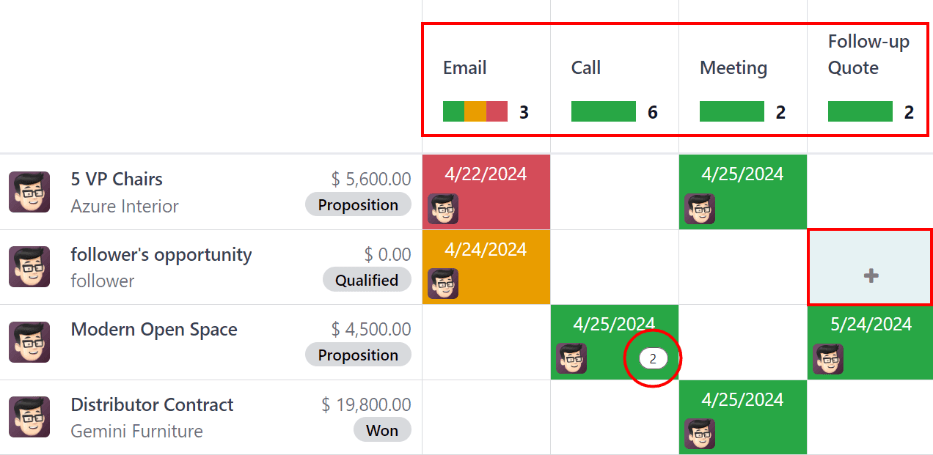

In this view, all the available activities are listed in the columns, while the horizontal entries represent all the individual records.

Activities that appear green have a due date in the future, activities that appear orange are due today, while activities appearing red are overdue.

Color bars in each column represent records for specific activity types, and display a number indicating how many activities are scheduled for that type.

If multiple activity types are scheduled for a record, a number appears in the box, indicating the total number of scheduled activities.

Note

Activity colors, and their relation to an activity’s due date, are consistent throughout Odoo, regardless of the activity type, or the view.

To schedule an activity for a record, hover over the corresponding field. Click the (plus) icon that appears, and then fill out the Schedule Activity form.

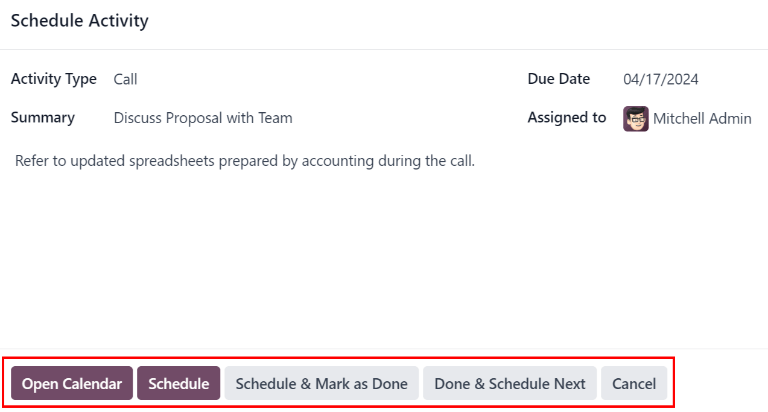

Schedule Activity form

Activities can be scheduled from many different places, such as from the chatter of a record, or from one of multiple views in an application, when available: the Kanban view, list view, or activity view.

Enter the following information on the form:

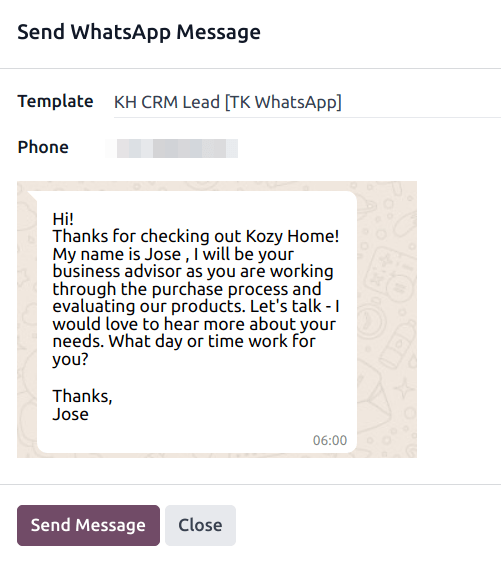

- Activity Type: select the type of activity from the drop-down menu. The default options are: Email, Call, Meeting, or To-Do. Depending on what other applications are installed, additional options may be available.

- Summary: enter a short title for the activity, such as Discuss Proposal.

- Due Date: using the calendar popover, select the activity’s deadline.

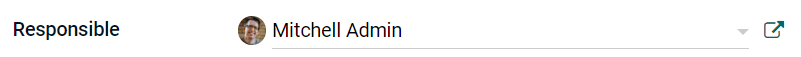

- Assigned to: by default, the current user populates this field. To assign a different user to the activity, select them from the drop-down menu.

- Notes: add any additional information for the activity in this field.

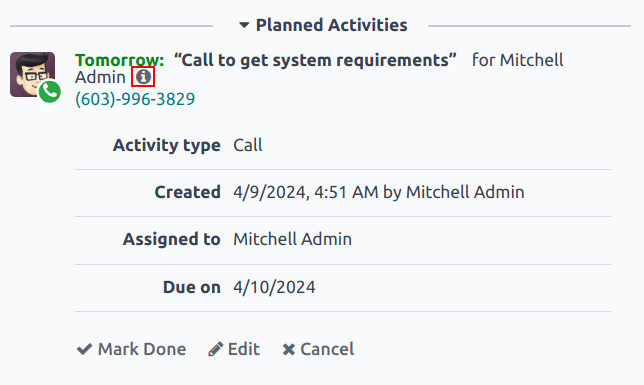

When the Schedule Activity pop-up window is completed, click one of the following buttons:

- Open Calendar: opens the user’s calendar to add and schedule the activity.

Click on the desired date and time for the activity, and a New Event pop-up window appears. The summary from the Schedule Activity pop-up window populates the Title field.

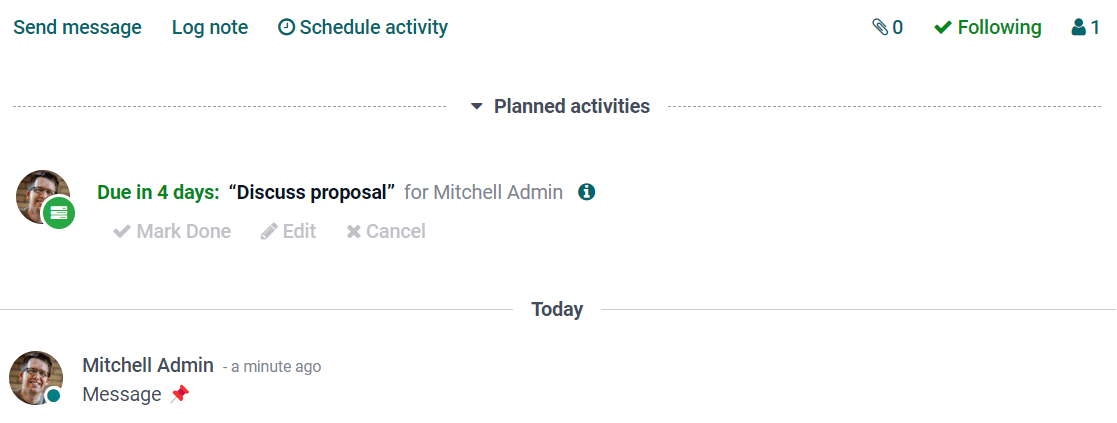

Enter the information in the New Event pop-up window, then click Save & Close to schedule it. Once scheduled, the activity is added to the chatter under the Planned Activities section.

Important

The Open Calendar button only appears if the Activity Type is set to either Call or Meeting. - Schedule: schedules the activity, and adds the activity to the chatter under Planned Activities.

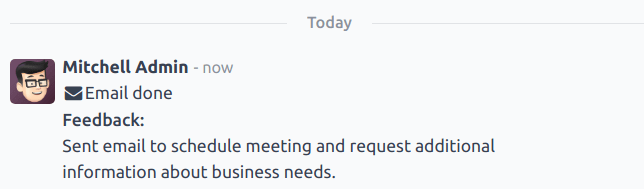

- Schedule & Mark as Done: adds the details of the activity to the chatter under Today. The activity is not scheduled, and is automatically marked as done.

- Done & Schedule Next: adds the details of the activity to the chatter under Today. The activity is not scheduled, is automatically marked as done, and a new Schedule Activity pop-up window appears.

- Cancel: discards any changes made on the Schedule Activity pop-up window.

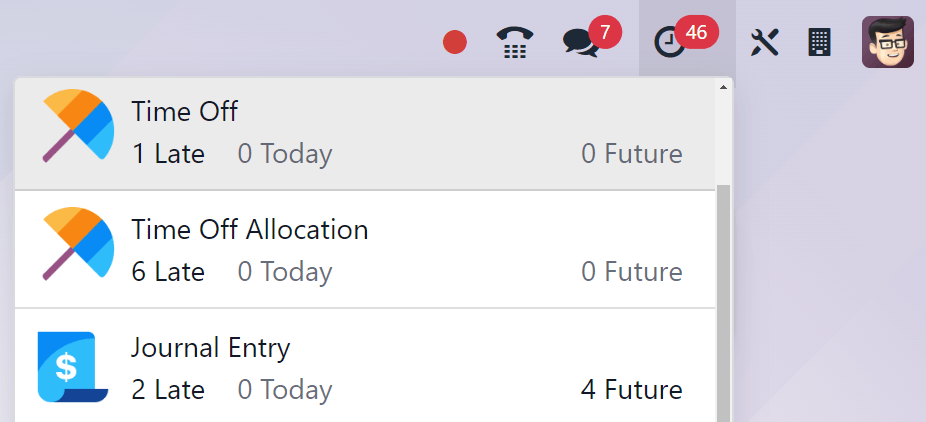

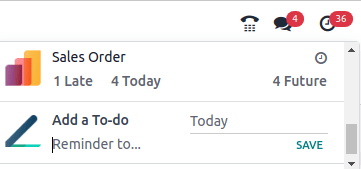

All scheduled activities

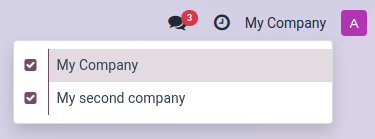

To view a consolidated list of activities, organized by application, click the (clock) icon in the header menu, located in the top-right corner.

If any activities are scheduled, the number of activities appear in a red bubble on the (clock) icon.

All activities for each application are further divided into subsections, indicating where in the application the activity is to be completed. Each sub-section lists the number of scheduled activities that are Late, due Today, and scheduled in the Future.

Example

In the Time Off application, one activity is scheduled to be done in the All Time Off requests dashboard, and six activities are scheduled to be done in the Allocations dashboard.

These requests appear in two separate lists in the all activities drop-down menu: one labeled Time Off and one labeled Time Off Allocation.

Request a document

The option to Request a Document is available at the bottom of the list of all scheduled activities, the option to Request a Document appears. Click Request a Document, and a Request a file pop-up window appears.

Enter the following information on the form:

- Document Name: enter a name for the document being requested.

- Request To: select the user the document is being requested from using the drop-down menu.

- Due Date In: enter a numerical value indicating when the document is due. Next to this field, a Days field is visible. Click Days, the default option, to reveal a drop-down menu. Select the desired time-frame option from the list. The options are Days, Weeks, or Months.

- Workspace: using the drop-down menu, select the specific Workspace the document is being uploaded to.

- Tags: select any desired tags from the drop-down menu. The available tags displayed are based on the tags configured for the selected Workspace.

- Message: enter a message to clarify the document request in this field.

When all the fields are completed, click Request to send the document request.

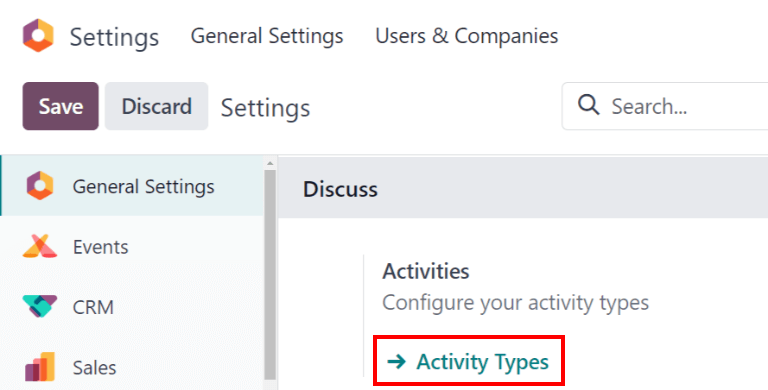

Activity types

To view the currently configured types of activities in the database, navigate to Settings app ‣ Discuss section ‣ Activities setting ‣ Activity Types.

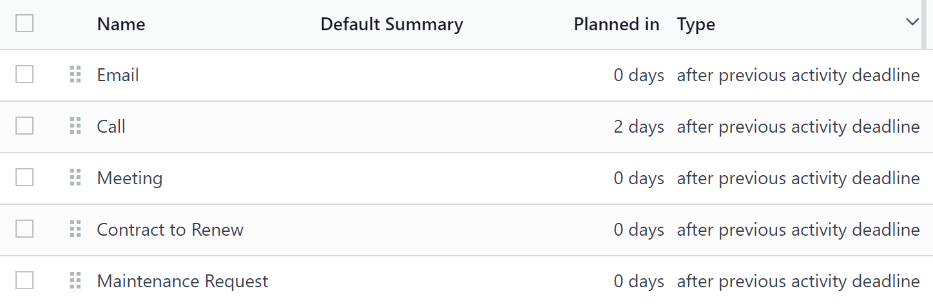

Doing so reveals the Activity Types page, where the existing activity types are found.

Tip

Individual applications have a list of Activity Types dedicated to that application. For example, to view and edit the activities available for the CRM application, go to CRM app ‣ Configuration ‣ Activity Types.

Edit activity types

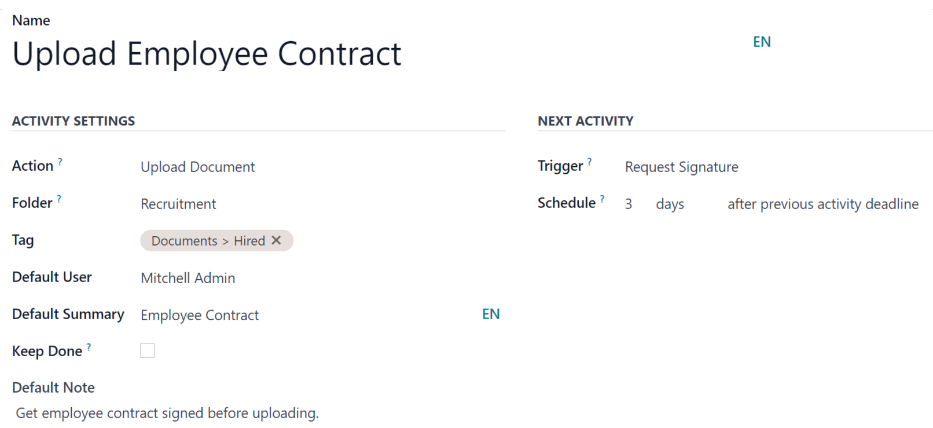

To edit an existing activity type, click on the activity type, and the activity type form loads.

Make any desired changes to the activity type form. The form automatically saves, but it can be saved manually at any time by clicking the Save Manually option, represented by a (cloud upload) icon, located in the top-left corner of the page.

Create new activity types

To create a new activity type, click New from the Activity Types page, and a blank activity type form loads.

Enter a Name for the activity type at the top of the form, then enter the following information on the form.

Activity Settings section

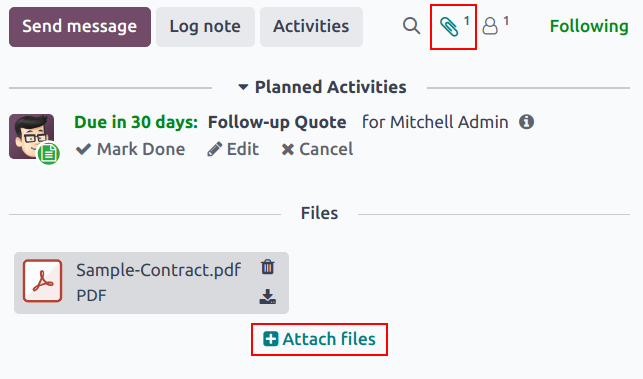

- Action: using the drop-down menu, select an action associated with this new activity type. Some actions trigger specific behaviors after an activity is scheduled, such as:

- Upload Document: if selected, a link to upload a document is automatically added to the planned activity in the chatter.

- Call or Meeting: if selected, users have the option to open their calendar to select a date and time for the activity.

- Request Signature: if selected, a link to open a signature request pop-up window is automatically added to the planned activity in the chatter. This requires the Odoo Sign application to be installed.

Available activity types vary based on the installed applications in the database. - Folder: select a specific workspace folder to save a document to. This field only appears if Upload Document is selected for the Action.

Using the drop-down menu, select the Folder the document is saved to. - Default User: select a user from the drop-down menu to automatically assign this activity to the selected user when this activity type is scheduled. If this field is left blank, the activity is assigned to the user who creates the activity.

- Default Summary: enter a note to include whenever this activity type is created.

Note

The information in the Default User and Default Summary fields are included when an activity is created. However, they can be altered before the activity is scheduled or saved. - Keep Done: tick this checkbox to keep activities that have been marked as Done visible in the activity view.

- Default Note: enter any notes to appear with the activity.

Next Activity section

It is possible to have another activity either suggested or triggered. To do so, configure the Next Activity section.

- Chaining Type: select either Suggest Next Activity or Trigger Next Activity from the drop-down menu. Depending on the selected option, either the Suggest or Trigger field is displayed.

Note

The Chaining Type field does not appear if Upload Document is selected for the Action. - Suggest/Trigger: depending on what is selected for the Chaining Type, this field either displays Suggest or Trigger. Using the drop-down menu, select the activity to recommend or schedule as a follow-up task to the activity type.

- Schedule: configure when the next activity is suggested or triggered.

First, enter a numerical value indicating when the activity is suggested or triggered.

Next to this field, a Days field is visible. Click Days, the default option, to reveal a drop-down menu. Select the desired time-frame option from the list. The options are Days, Weeks, or Months.

Lastly, using the drop-down menu, select whether the activity is scheduled or triggered either after previous activity deadline or after completion date.

See also

On this page

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

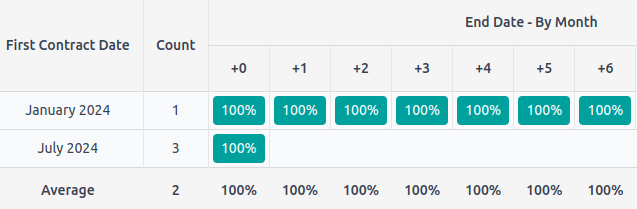

Reporting

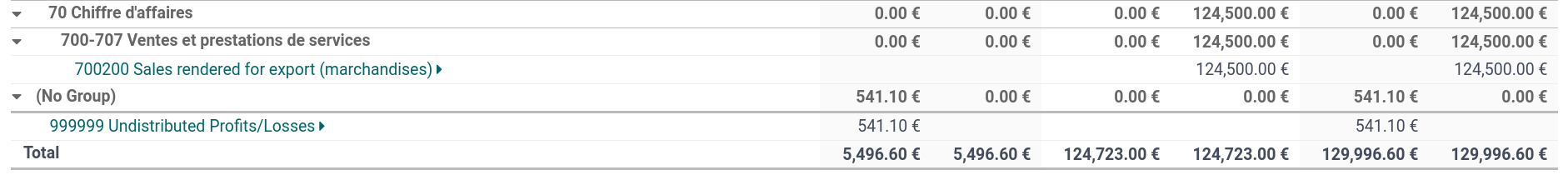

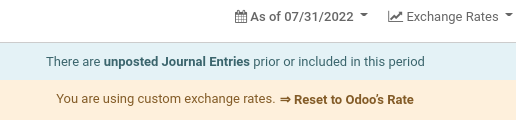

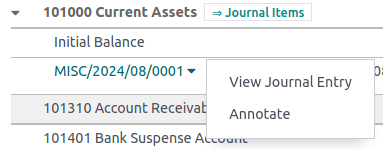

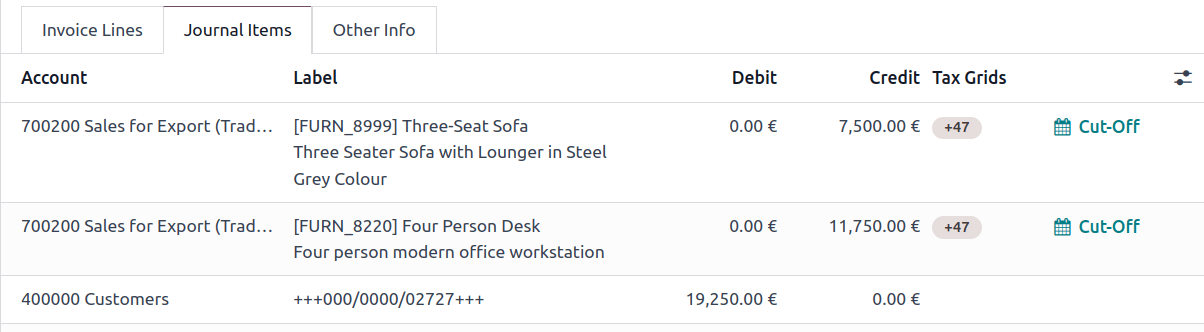

You can find several reports under the Reporting menu of most apps that let you analyze and visualize the data of your records.

Selecting a view

Depending on the report, Odoo can display the data in various ways. Sometimes, a unique view fully tailored to the report is available, while several views are available for others. However, two generic views are dedicated to reporting: the graph and pivot views.

Graph view

The graph view is used to visualize your records’ data, helping you identify patterns and trends. The view is often found under the Reporting menu of apps but can be found elsewhere. Click the graph view button located at the top right to access it.

Pivot view

The pivot view is used to aggregate your records’ data and break it down for analysis. The view is often found under the Reporting menu of apps but can be found elsewhere. Click the pivot view button located at the top right to access it.

Choosing measures

After selecting a view, you should ensure only the relevant records are filtered. Next, you should choose what is measured. By default, a measure is always selected. If you wish to edit it, click Measures and choose one or, only for pivots, multiple measures.

Note

When you select a measure, Odoo aggregates the values recorded on that field for the filtered records. Only numerical fields (integer, decimal, monetary) can be measured. In addition, the Count option is used to count the total number of filtered records.

After choosing what you want to measure, you can define how the data should be grouped depending on the dimension you want to analyze. By default, the data is often grouped by Date > Month, which is used to analyze the evolution of a measure over the months.

Tip

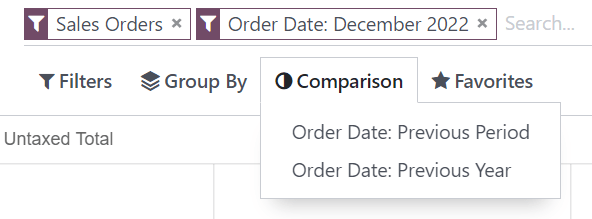

When you filter a single time period, the option to compare it against another one appears.

Example

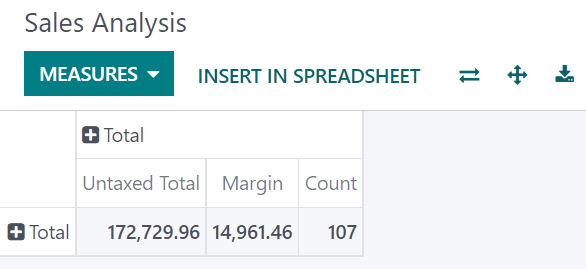

Select measuresGroup measures

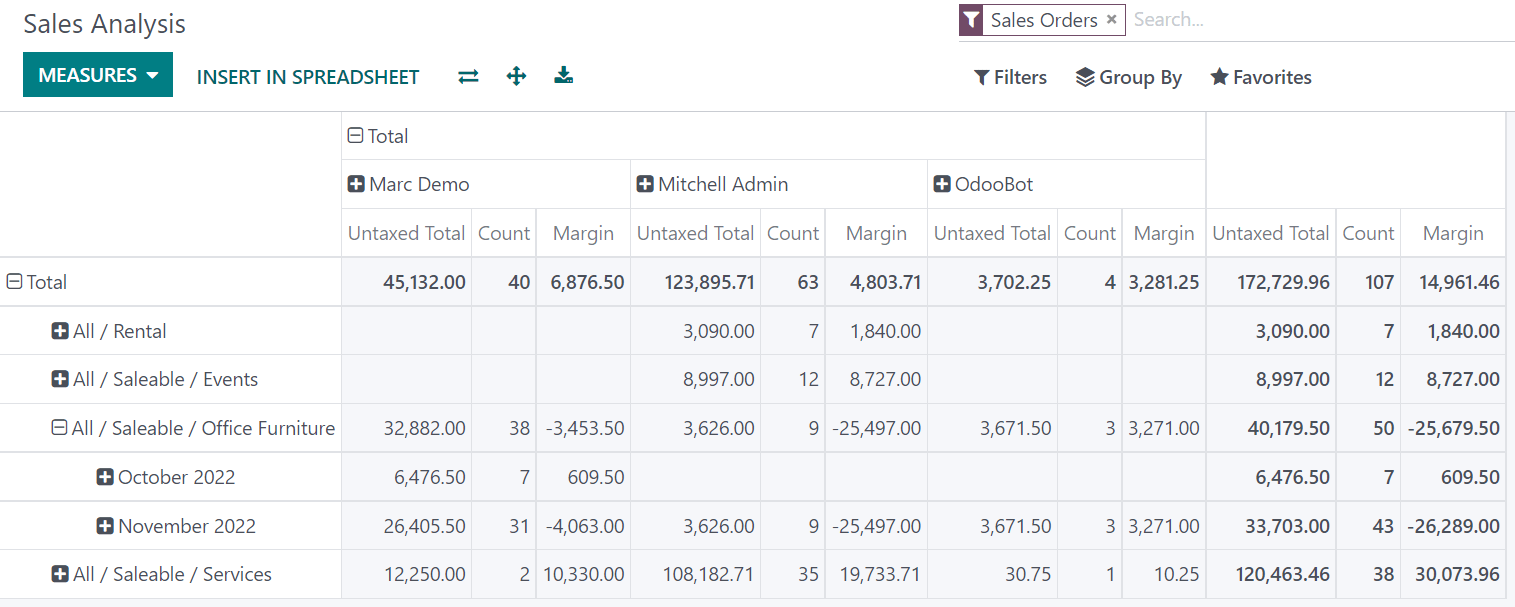

Among other measures, you could add the Margin and Count measures to the Sales Analysis report. By default, the Untaxed Amount measure is selected.

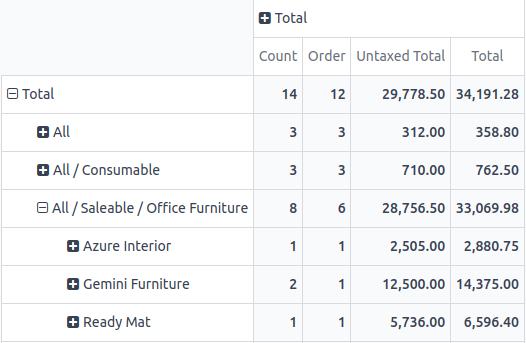

Using the pivot view

Grouping data is quintessential to the pivot view. It enables drilling down the data to gain deeper insights. While you can use the Group By option to quickly add a group at the level of rows, as shown in the example above, you can also click the plus button (➕) next to the Total header at the level of rows and columns, and then select one of the preconfigured groups. To remove one, click the minus button (➖).

Once you have added a group, you can add new ones on the opposite axis or the newly created subgroups.

Example

You could further divide the measures on the previous Sales Analysis report example by the Salesperson group at the level of columns and by the Order Date > Month group on the All / Saleable / Office Furniture product category.

Tip

- Switch the rows and columns’ groups by clicking the flip axis button (⇄).

- Click on a measure’s label to sort the values by ascending (⏶) or descending (⏷) order.

- Download a .xlsx version of the pivot by clicking the download button (⭳).

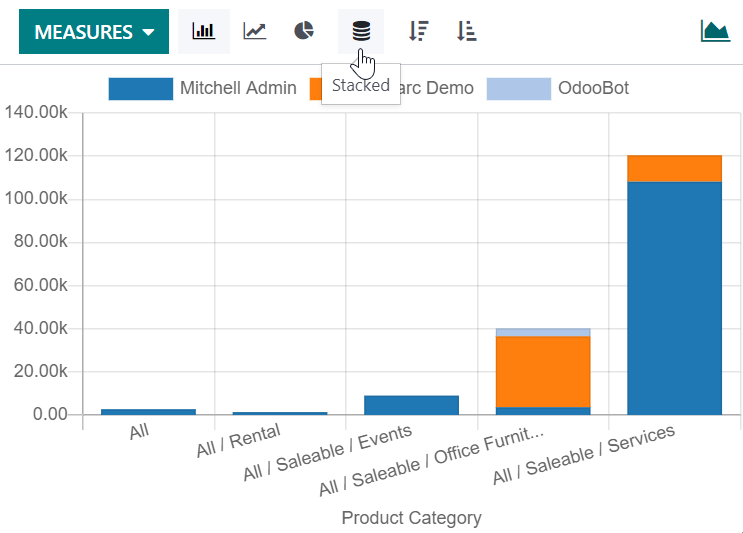

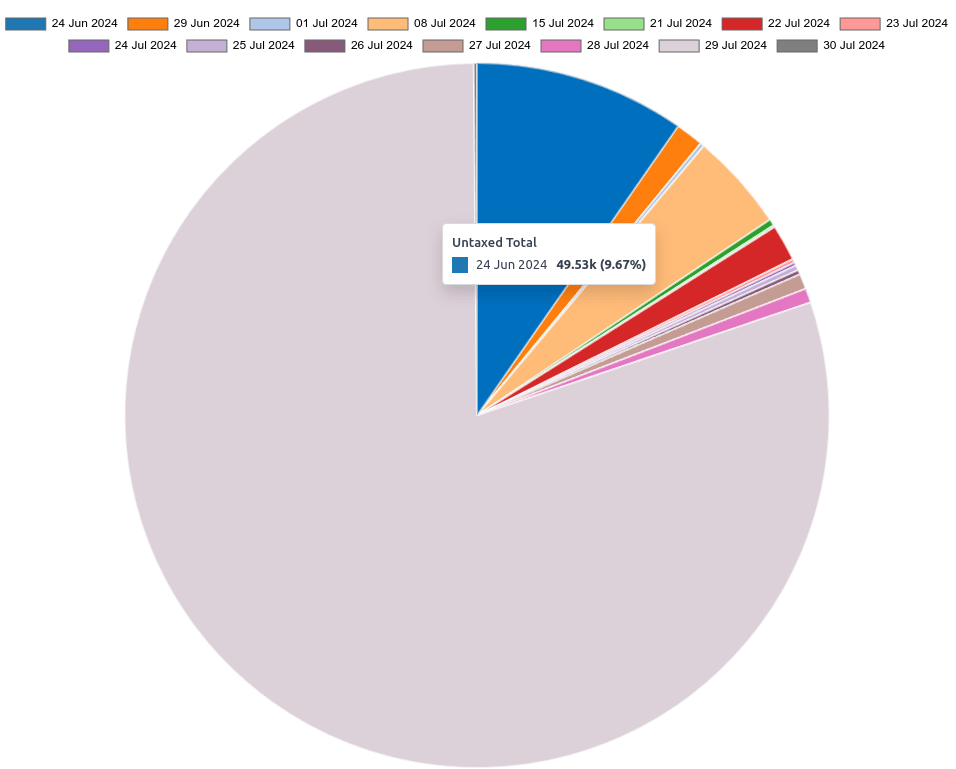

Using the graph view

Three graphs are available: the bar, line, and pie charts.

Bar charts are used to show the distribution or a comparison of several categories. They are especially useful as they can deal with larger data sets.

Line charts are useful to show changing time series and trends over time.

Pie charts are used to show the distribution or a comparison of a small number of categories when they form a meaningful whole.

Bar chartLine chartPie chart

Tip

For bar and line charts, you can use the stacked option when you have at least two groups, which then appear on top of each other instead of next to each other.

Stacked bar chartRegular bar chartStacked line chartRegular line chart

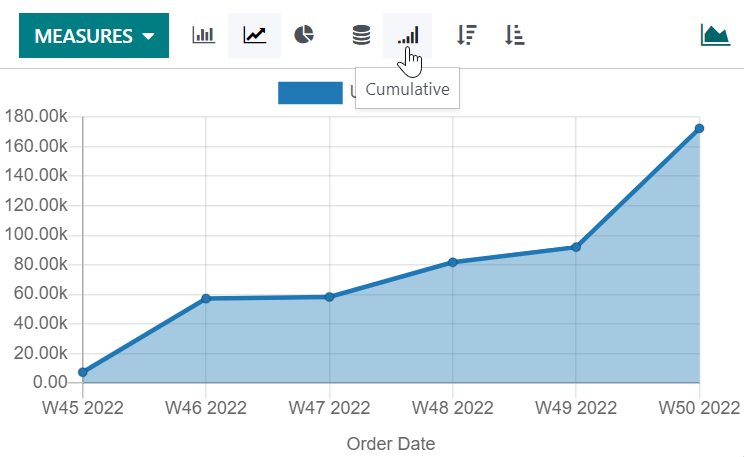

For line charts, you can use the cumulative option to sum values, which is especially useful to show the change in growth over a time period.

Cumulative line chartRegular line chart

On this page

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

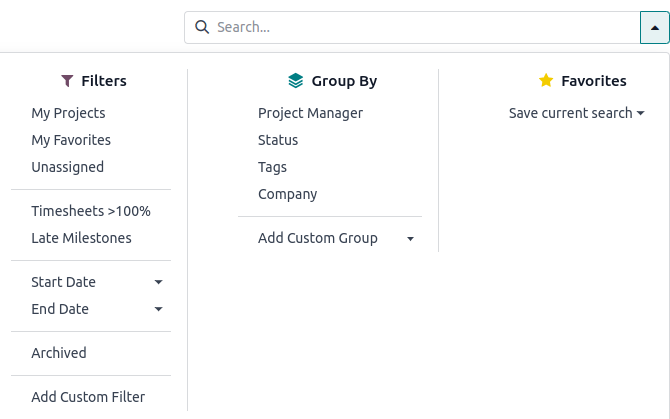

Search, filter, and group records

Odoo allows for the searching, filtering, and grouping of records in a view to display only the most relevant records. The search bar is located at the top of the view: start typing to search for values, or click the (dropdown) icon to access the Filter, Group By, and Favorites drop-down menus.

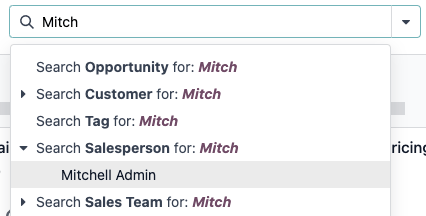

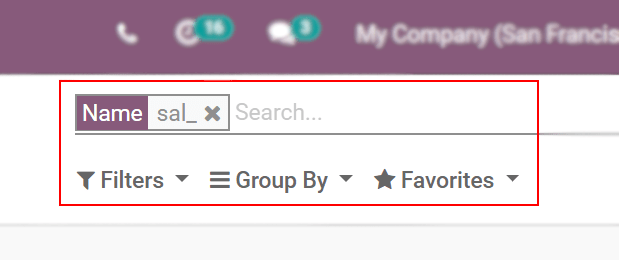

Search for values

Use the search field to look for specific values, and add them as a filter. Type the value to search for (like a salesperson’s name or a product), and select the desired option from the drop-down menu to apply the search filter.

Example

Instead of adding a custom filter to select records where Mitchell Admin is the salesperson on the Sales Analysis report (Sales app ‣ Reporting ‣ Sales), search for Mitch, and click the (submenu) icon next to Search Salesperson for: Mitch, and select Mitchell Admin.

Note

Using the search field is equivalent to using the contains operator when adding a custom filter. If a partial value is entered, and the desired field is directly selected (without selecting the (submenu), all records containing the typed characters for the selected field are included.

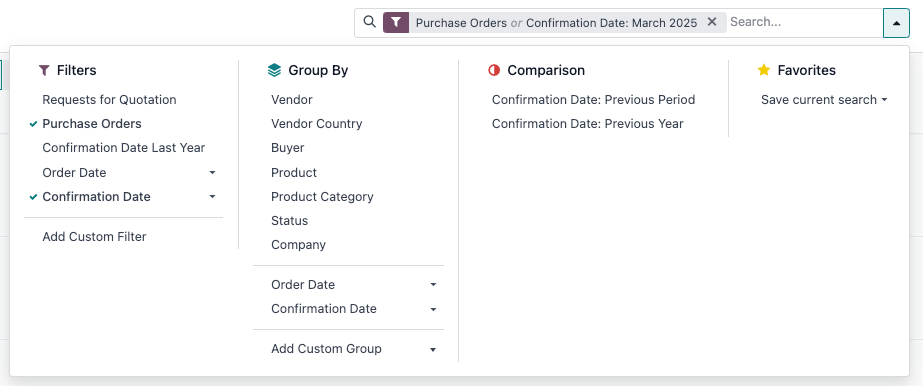

Filters

Filters are used to select records that meet specific criteria. The default selection of records is specific to each view, but can be modified by selecting one (or several) preconfigured filters, or by adding a custom filter.

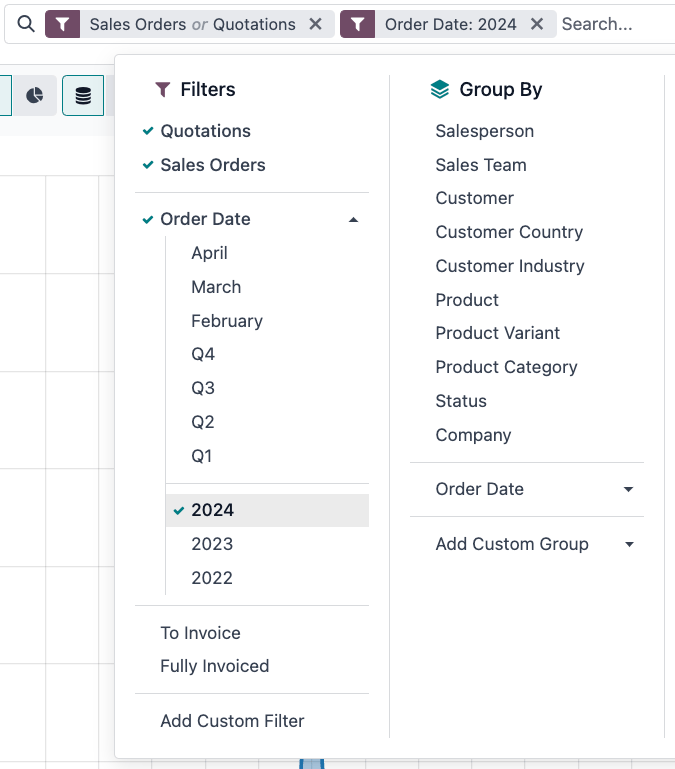

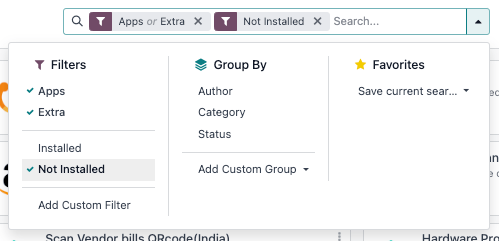

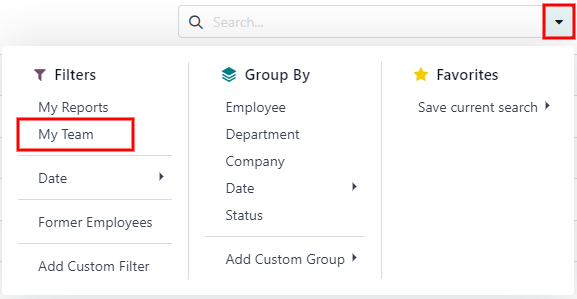

Preconfigured filters

Modify the default selection of records by clicking the (dropdown) from the search bar, and selecting one (or several) preconfigured filters from the Filters drop-down menu.

Example

On the Sales Analysis report (Sales app ‣ Reporting ‣ Sales), only records that are at the sales order stage, with an order date within the last 365 days, are selected by default.

To also include records at the quotation stage, select Quotations from the Filters.

Furthermore, to only include sales order and quotation records from a specific year, like 2024, for example, first remove the existing Order Date: Last 365 Days filter by clicking (cancel), then select the Order Date ‣ 2024 filter.

Note

The preconfigured Filters are grouped, and each group is separated by a horizontal line. Selecting preconfigured filters from the same group allows records to match any of the applied conditions. However, selecting filters from different groups requires records to match all of the applied conditions.

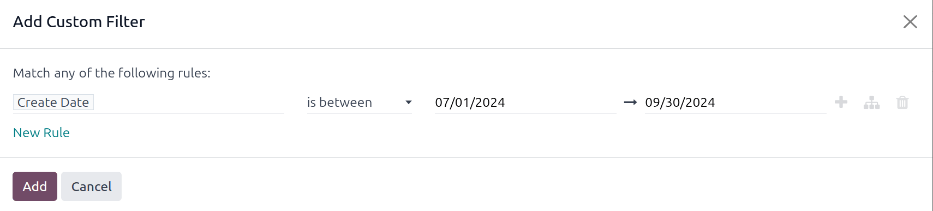

Custom filters

If the preconfigured filters are not specific enough, add a custom filter. To do so, click the (dropdown) icon in the search bar, then select Filters ‣ Add Custom Filter.

The Add Custom Filter pop-up window displays the matching option, filter rule, and a toggle to Include archived records.

The default matching configuration is to Match any of the following rules, indicating that each filter rule is applied independently. To change the matching configuration to Match all of the following rules, at least two filter rules must be added to the custom filter.

- Match all of the following rules: All of the filter rules must be met. Think of this as an AND (&) operation.

- Match any of the following rules: Any of the filter rules can be met. Think of this as an OR (|) operation.

By default, a single filter rule is added to the custom filter. The following describes the structure of a filter rule:

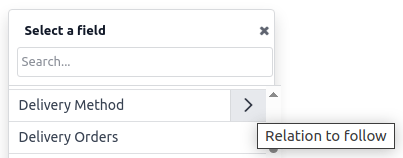

- The first inline field is the field name to filter by. Some fields have refined parameters that are nested within another field. These fields have a (submenu) icon beside them, which can be selected to reveal the nested fields.

- The second inline field is the conditional operator used to compare the field name to the value. The available conditional operators are specific to the field’s data type.

- The third inline field is the variable value of the field name. The value input may appear as a drop-down menu, a text input, a number input, a date/time input, a boolean selector, or it may be blank, depending on the operator used and the field’s data type.

Three inline buttons are also available to the right of the rule’s filter criteria:

- (plus): Adds a new rule below the existing rule.

- (node): Adds a new group of rules below the existing rule, with the any and all matching options available to define how each rule within this branch is applied to the filter. If the matching option is set to the same as the parent group, the fields are moved to join the parent group.

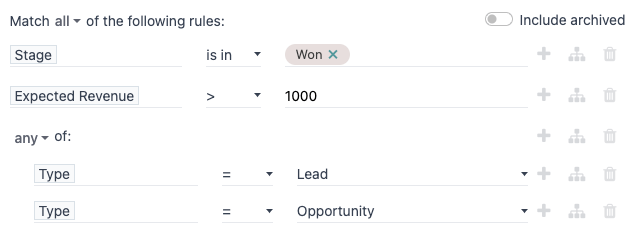

Example

If the matching option is set to Match all of the following rules, and a new branch is added with its matching option changed from any of to all of, the newly-added branch disappears, and its group of rules are moved to the parent group. - (delete): Deletes the node. If a branch node is deleted, all children of that node are deleted, as well.

A new filter rule can be added to the custom filter by clicking the New Rule button.

Once the filter criteria are defined, click Add to add the custom filter to the view.

Example

To target all leads and opportunities from the CRM app that are in the Won stage, and have an expected revenue greater than $1,000, the following should be entered:

Match all of the following rules:

- Stage is in Won

- Expected Revenue > 1,000

- any of:

- Type = Lead

- Type = Opportunity

Tip

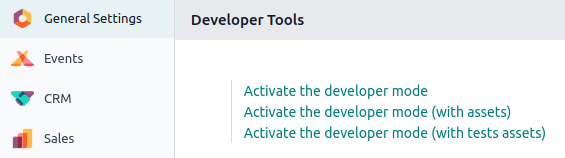

Activate Developer mode (debug mode) to reveal each field’s technical name and data type, as well as the # Code editor text area below the filter rules, to view and edit the domain manually.

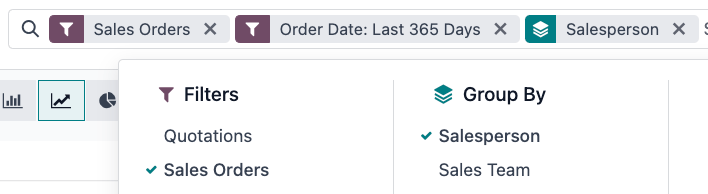

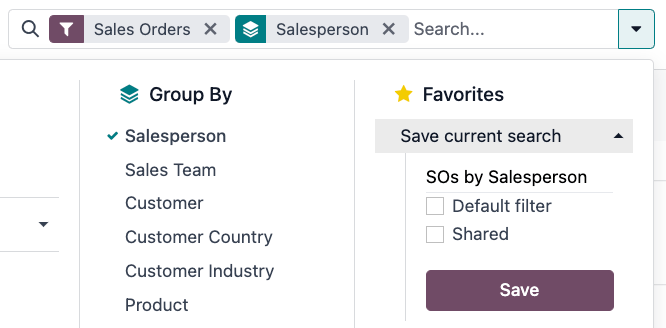

Group records

The display of records in a view can be clustered together, according to one of the preconfigured groups. To do so, click the (dropdown) icon in the search bar, then select one of the Group By options from the drop-down menu.

Example

To group the records by salesperson on the Sales Analysis report (Sales app ‣ Reporting ‣ Sales), click the Salesperson option from the Group By drop-down menu. The view changes to group the records by salesperson, without filtering out any records.

It is possible to customize groups by using a field present on the model. To do so, click Add Custom Group, and select a field from the drop-down menu.

Note

Several groups can be used at the same time. The first group that is selected is the main cluster, the next one that is added further divides the main group’s categories, and so on. Furthermore, filters and groups can be used together to refine the view even more.

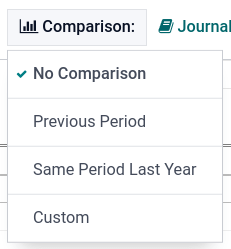

Comparison

Certain reporting dashboards include a Comparison section in the drop-down menus of their search bars. This includes the Overall Equipment Effectiveness report for the Manufacturing app and the Purchase report for the Purchase app, among others.

The options in the Comparison section are used to compare data from two different time periods. Pick between the two comparison options: (Time Filter): Previous Period and (Time Filter): Previous Year.

Important

For some reports, the Comparison section only appears in the search bar drop-down

menu if one (or more) time periods have been selected in the Filters column. This is because there is nothing to compare if no time period is specified.

Additionally, some reports only allow use of the Comparison feature when the (Pie Chart) graph type or the (Pivot) view, is selected. A Comparison option can be selected even if another view is enabled, but doing so does not change the way data is displayed on the report.

To view data using one of the two comparisons, begin by selecting a time period in the Filters column of the search bar drop-down menu. Then, select either (Time Filter): Previous Period or (Time Filter): Previous Year in the Comparison section.

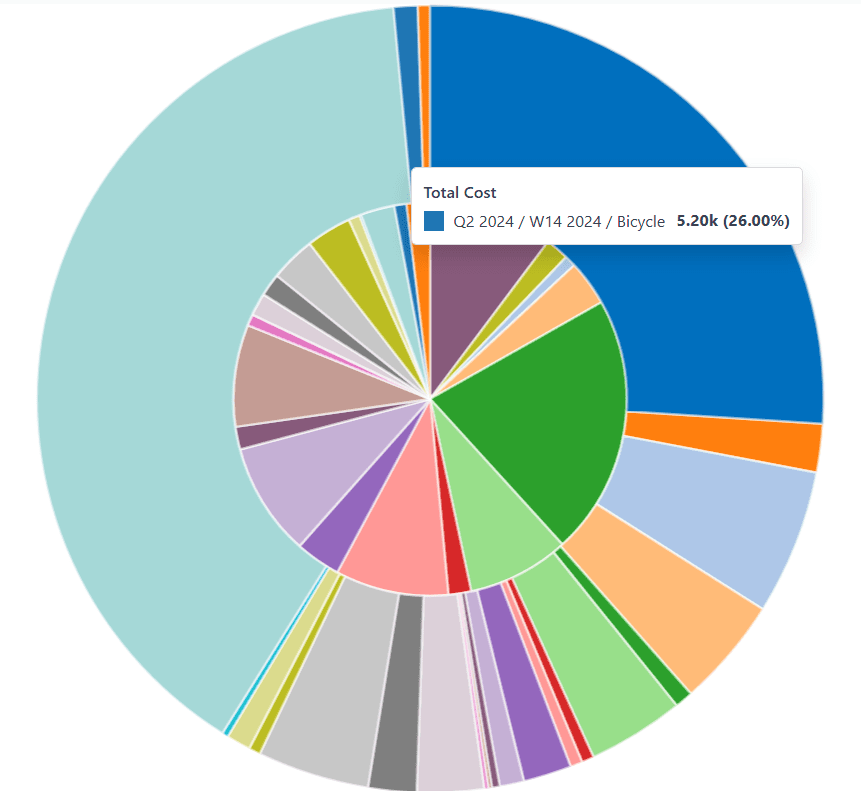

With one of the Comparison options enabled, the report compares the data for the selected period, with the data for the same unit of time (month, quarter, year), one period or year prior. The way the data is displayed depends on the selected view:

- The (Bar Chart) shows two bars, side-by-side, for each unit of time for the selected time period. The left bar represents the selected time period, while the right bar represents the previous time period.

- The (Line Chart) is displayed with two lines, one representing the selected time period, and the other representing the previous time period.

- The (Pie Chart) appears as a large circle with a smaller circle inside. The larger circle represents the selected time period, while the smaller circle represents the previous time period.

- The (Pivot) is displayed with each column split into two smaller columns. The right column represents the selected time period, while the left column represents the previous time period.

Example

In the Production Analysis report of the Manufacturing app, data for the second quarter of 2024 is compared to data for the second quarter of 2023. Q2 is selected in the End Date filter section of the search bar drop-down menu. In the Comparison section, End Date: Previous Year is selected.

The current year is 2024, so the larger circle shows data for the second quarter (Q2) of 2024. The smaller circle shows data for the second quarter (Q2) of 2023, which is the same time period, but one year prior.

If End Date: Previous Period is selected instead, the smaller circle shows data for the first quarter (Q1) of 2024, which is the same time period, but one period prior.

Favorites

Favorites are a way to save a specific search for future use, or as the new default filter for the view.

To save the current view as a favorite, click the (dropdown) icon in the search bar, then select the Save current search drop-down menu to display the following options:

- Filter name: Name of the favorited search.

- Default filter: Sets the favorited search as the default filter for the view.

- Shared: Makes the favorited search available to all users. Otherwise, by default, the favorited search is only available to the user who created it.

Once the options are set, click Save to save the favorited search.

Saved favorites can be accessed by clicking the (delete) icon in the search bar, then selecting the saved filter in the Favorites drop-down menu. To remove a saved favorite, click the (delete) icon next to the favorited search.

Tip

To view all favorited searches, first activate Developer mode (debug mode), and navigate to Settings app ‣ Technical ‣ User Interface: User-defined Filters. From here, all favorited searches can be viewed, edited, archived, or deleted.

On this page

Get Help

Contact Support Ask the Odoo Community

docs

- Try Odoo for FREE

- EN

- Odoo 18

- Article creation and editing

- Article creation

- Knowledge articles can be created from scratch or from a preconfigured template.

- From scratch

- To create an article from scratch, click New in the top right corner or hover over the Private or Workspace category in the sidebar tree, then click the (plus) icon. Start typing text or select one of the suggested options:

- Load a Template: Select a preconfigured template and click Load Template.

- Build an Item Kanban: Create items to visualize and manage them in a Kanban view.

- Build an Item List: Create a structured list of items to centralize them in a single article.

- Build an Item Calendar: Create a calendar view to manage and track items by date.

- Generate an Article with AI: Generate content based on a prompt.

- Tip

- After writing the header, click or hover over Untitled in the top bar to automatically name the article after the header. This does not apply if the article is already titled.

- From a template

- To create an article from a template, follow these steps:

- Click Browse Templates at the bottom of the sidebar tree.

- Select a preferred template.

- Click Load Template.

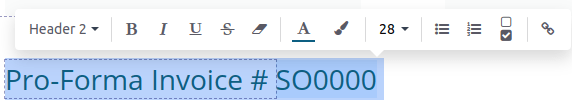

- Article editing

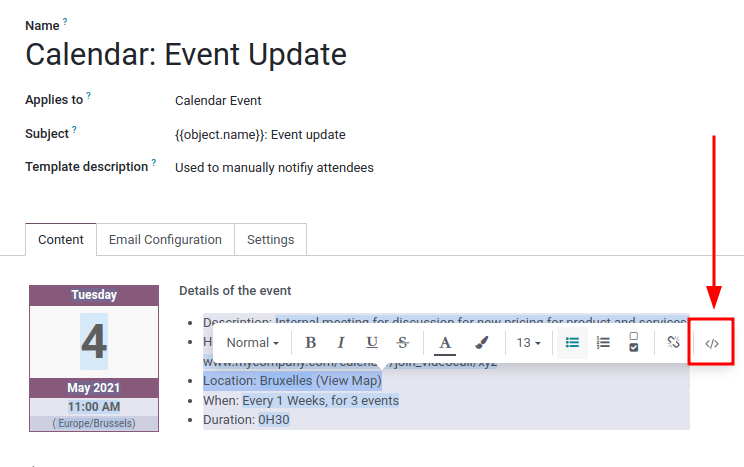

- To edit an article, select it in the sidebar tree, then edit its content and format it using the text editor toolbar, by typing powerbox commands, and adding a cover picture with a title emoji.

- Text editor toolbar

- To edit a word, sentence, or paragraph, select or double-click it to display the text editor toolbar and apply the desired formatting options.

- Tip

- Click Comment to add a comment to the selected text.

- Commands

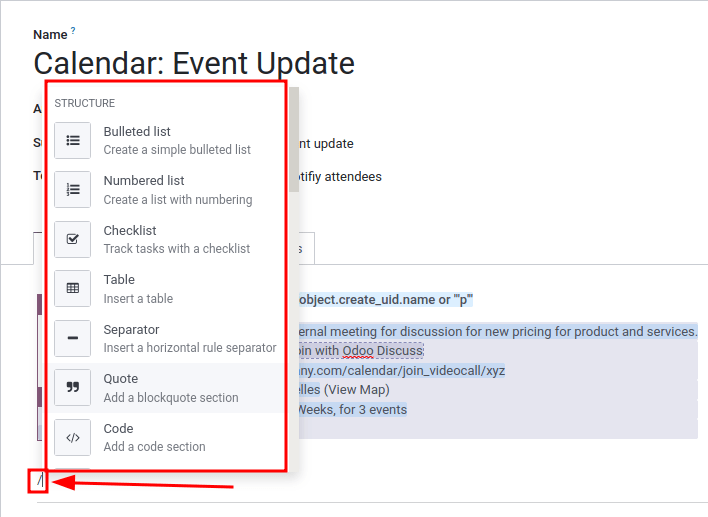

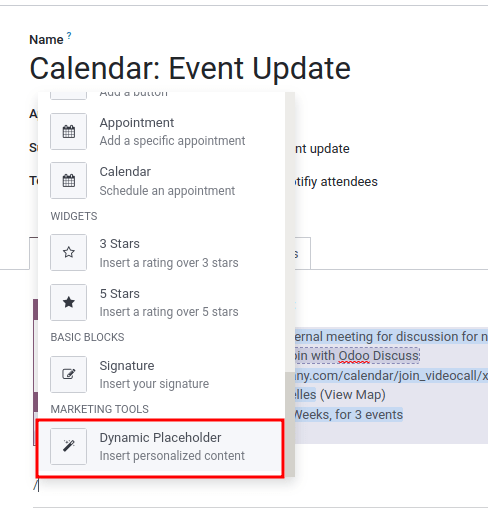

- Type / to open the powerbox and use a command. The following commands are exclusive to the Knowledge app:

- Cover pictures

- To add a cover picture, click the (ellipsis) icon, then Add Cover. The following options enable selecting and inserting pictures from different sources:

- Search the Unsplash database to find a suitable picture. If your database and your Unsplash account are associated, the cover picture is automatically selected based on the article’s name.

- Add URL: Copy-paste the image address.

- Upload an image: Upload the file into the image library.

- To manage the cover picture, hover the mouse over it and select the preferred option:

- Replace Cover and search from the database or library, or add a different URL.

- Reposition and adjust the picture before clicking Save Position.

- Remove Cover.

- Title emoji

- To add a title emoji to the article’s name and header:

- Click the (ellipsis) icon, then Add Icon to generate a random emoji. Click the emoji to select a different one.

- Alternatively, click the (page) icon next to the article’s name in the sidebar or the top bar and select the preferred emoji.

- Views and links from other apps

- To insert a view or a view link into an article, follow these steps:

- Go to the desired app and select the preferred view.

- Click the (cog) icon, then select Knowledge ‣ Insert view in article or Insert link in article.

- Choose the article to insert the view or link to.

- Note

- Once the view or link is inserted:

- Users without access to the view cannot see it in Knowledge, even if they can access the article containing it.

- Clicking the inserted link opens a pop-up with the view’s name next to the (copy), (edit), and (remove) icons. Click the name inside the pop-up to open the linked view.

- Edit on GitHub

- On this page

- Get Help

- Contact Support Ask the Odoo Community

Command | Use |

|---|---|

Index | Show nested articles: Display the child pages of the parent article. |

Item Kanban | Insert a Kanban view and create items. |

Item Cards | Insert a Card view and create items. |

Item List | Insert a List view and create items. |

Item Calendar | Insert a Calendar view and create items. |

EN

Odoo 18

Articles management

Managing articles effectively is key to maximizing the value of your knowledge resources, whether working on a research project, studying for an exam, or building a knowledge database for your business. Knowledge allows you to fully manage your articles, from creation to removal, through sharing and structure.

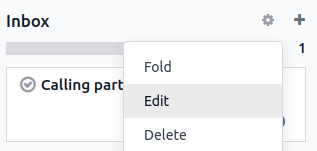

You can find most tools to manage articles by clicking the vertical ellipsis button (⋮) at the right side of the top bar. From there, you can move, lock, delete, or duplicate an article.

Creation, sharing, and removal of articles

Creation

To create articles, click the + New button on the right side of the top bar or the + button next to a category or another article.

Tip

Create private articles quickly with the Alt/Option + C keyboard shortcut.

Sharing

You can share articles with internal or external users. To do so, open the share menu by clicking Share in the top-right menu of articles.

Invite users

To share articles with specific users (internal or external, such as a partner or a customer), click Invite. This opens a pop-up window in which you can choose the Permission (i.e, access rights) and enter the Recipients’ name or email.

You can also restrict a specific user from accessing the article by selecting No access permission.

Share online

To share articles online, activate the Share to web button. Doing so generates a URL link anyone can use to view the article.

Additionally, the share menu displays the default permission for internal members along with all the users who have been granted specific permission.

Removal

To remove an article, you can either delete it or archive it.

To delete an article, open it and click the vertical ellipsis button (⋮) ‣ Delete. The article is moved to the trash for 30 days before being permanently deleted. To restore it, click Open the Trash, select the article, and click Restore.

To archive articles, click Search, select the article(s), and click Action ‣ Archive ‣ Archive. Archived articles are hidden from the search menu. To retrieve an archived article, add a custom filter to display them (Search ‣ Filters ‣ Add Custom Filter, and set Active as is No). Then, select the article(s) and go to Action ‣ Unarchive.

Structure of articles

Articles are organized into a hierarchical structure wherein the article on top is a parent article, and those underneath are called nested articles. This structure allows the grouping of related articles.

To establish this hierarchy, create new articles by clicking the + button next to the parent-to-be article, or move existing articles by either dragging and dropping them under the parent-to-be or by clicking the vertical ellipsis button (⋮), clicking Move To on the toolbox and selecting the article to use as a parent.

Categories

Additionally, articles are divided into four categories that can be found on the left sidebar. These categories give articles default access rights.

- Favorites: You can set any article you can access as a favorite. To do so, click the star-shaped icon (★) in the top-right menu of articles. Marking articles as favorites is user-specific and does not affect other users.

- Workspace: Articles displayed in that category are available to all internal users. These users have the right to read, modify or share these articles.

- Shared: Articles displayed in that category are those you shared with internal users, external users, or shared with you.

- Private: Articles displayed in that category are only available to you.

On this page

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

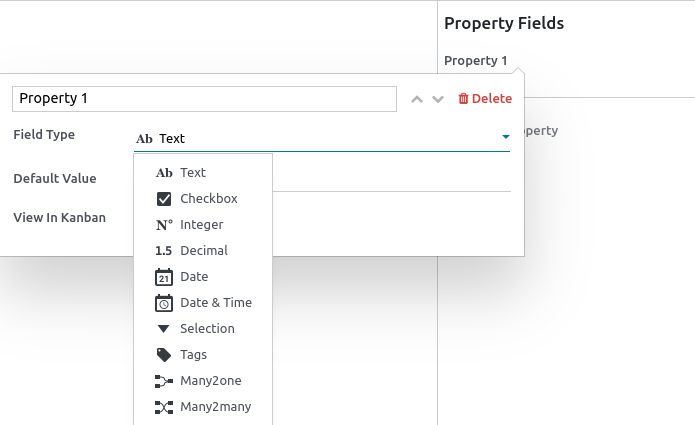

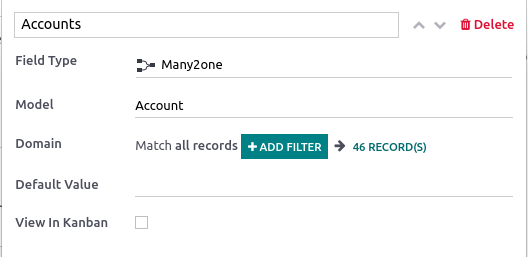

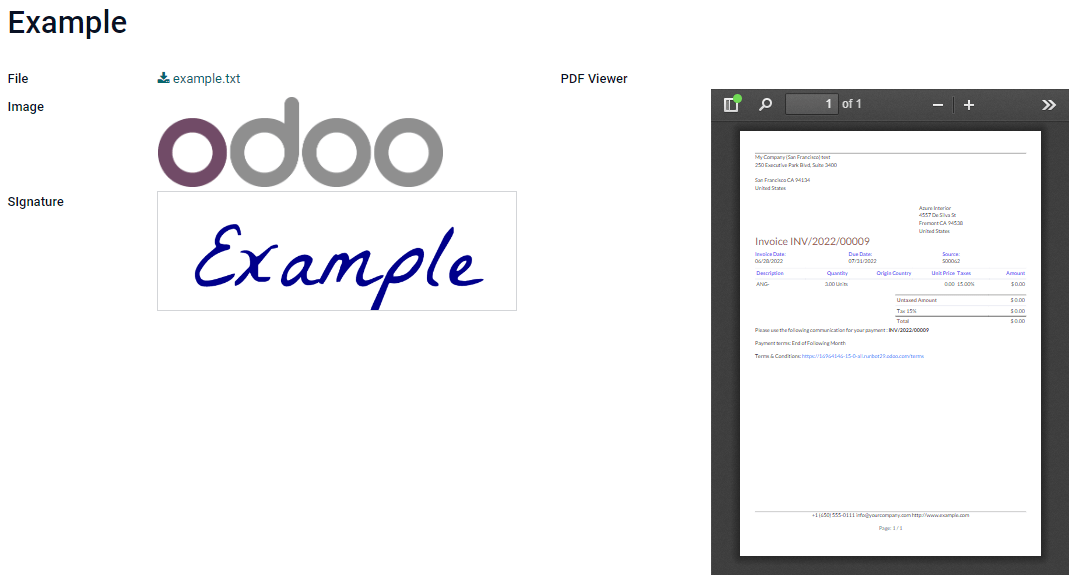

Properties

Properties are fields containing data and that can be added to articles by any user with write access. These fields are shared between all the child articles and article items under the same parent.

Note

To be able to add properties, an article must be either a child article or an article item.

Add property fields

Hover above the first-level header to make the buttons appear. Click ⚙ Add Properties ‣ Field Type, select the type and add a default value if needed. To make the fields appear in kanban views, check View in Kanban as well. To validate and close the property creation window, click anywhere.

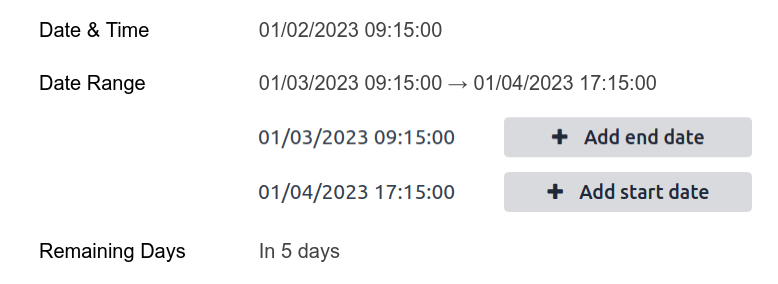

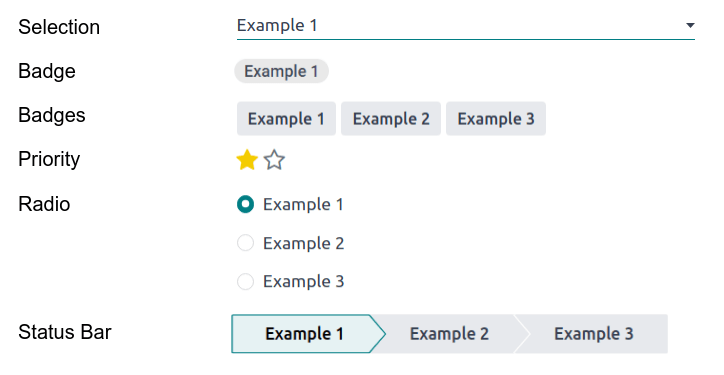

The different types assess what the field content can be:

Types | Uses |

|---|---|

Text | Allows adding any content with no restriction. |

Checkbox | Add a checkbox. |

Integer | Allows adding integer numbers. |

Decimal | Allows adding any number. |

Date | Allows selecting a date. |

Date & Time | Allows selecting a date and time. |

Some field types need to be configured:

Types | Uses |

|---|---|

Selection | Add a drop-down selection menu with restricted values that have been set at the property creation. To set it up, click Add a Value next to the Values field. Enter predetermined values and press enter to validate; you can enter as many values as needed. Click anywhere to close the property creation window. |

Tags | Allows creating and applying as many tags as needed. To set it up, enter your new_tag in the Tags field, and press enter or click Create “new_tag”. Click anywhere to close the window. Then, add the tags into the property field. To do so, click the property field and choose from the created tags; enter the tags’ name and press enter; enter a new tag’s name and create a new one on the spot. |

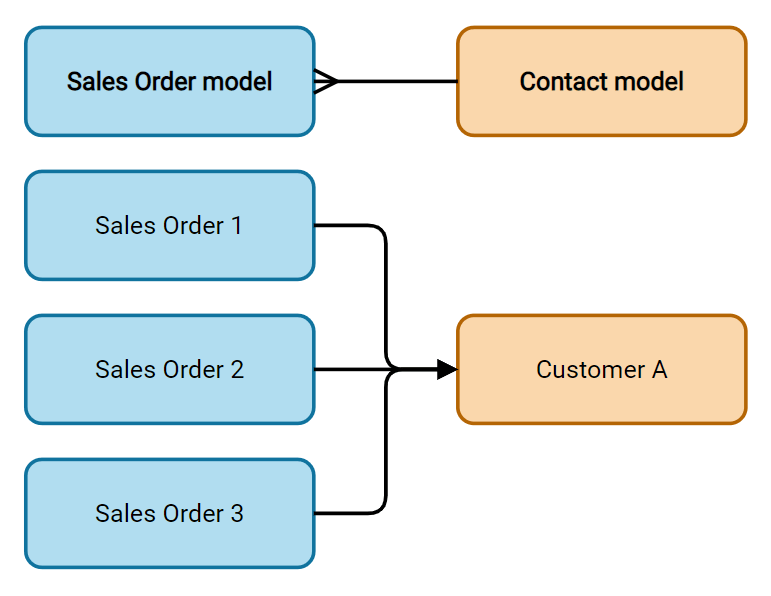

Many2one | Choose from a list of records that result from a model’s domain. You can only select one result. To set it up, click Search a Model in the Model field, select the model. Match all records by clicking ## Record(s), or filter the results by clicking + Add Filter and show the records by clicking ## Record(s). |

Many2many | Choose from a list of records that result from a model’s domain. You can select as many results as needed. To set it up, click Search a Model in the Model field, select the model. Match all records by clicking ## Record(s), or filter the results by clicking + Add Filter and show the records by clicking ## Record(s). |

Delete property fields

To remove a property, click the pencil icon next to the targeted property, then click Delete ‣ Delete.

Warning

Once a property field is deleted, you cannot retrieve it.

Hide the property panel

To hide the property sidebar panel, click the gear (⚙) button.

On this page

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

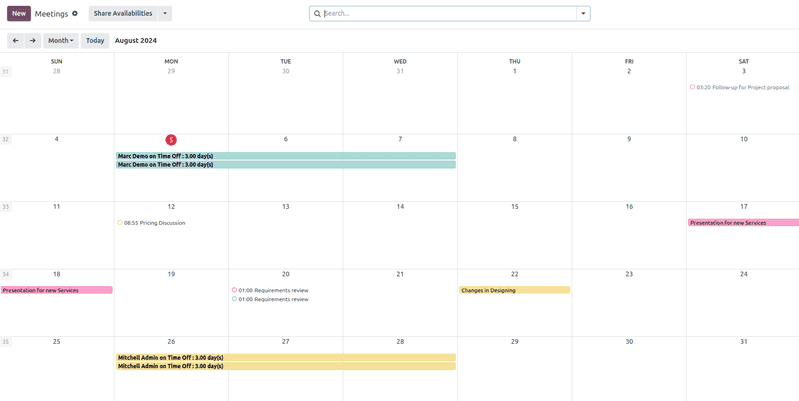

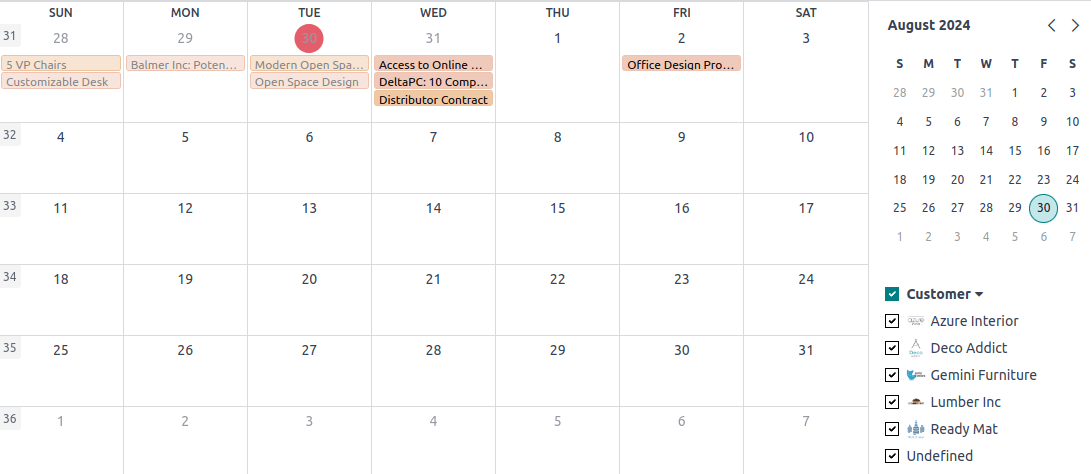

Calendar

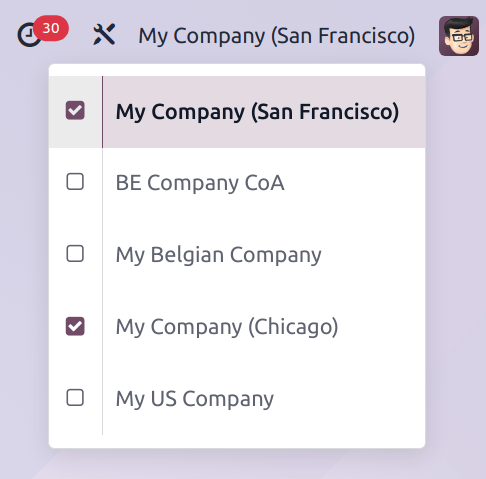

Odoo Calendar is a scheduling app that allows users to integrate a company’s business flow into a single management platform. By integrating with the other apps in Odoo’s ecosystem, Calendar allows users to schedule and organize meetings, schedule events, plan employee appraisals, coordinate projects, and more – all from the same platform.

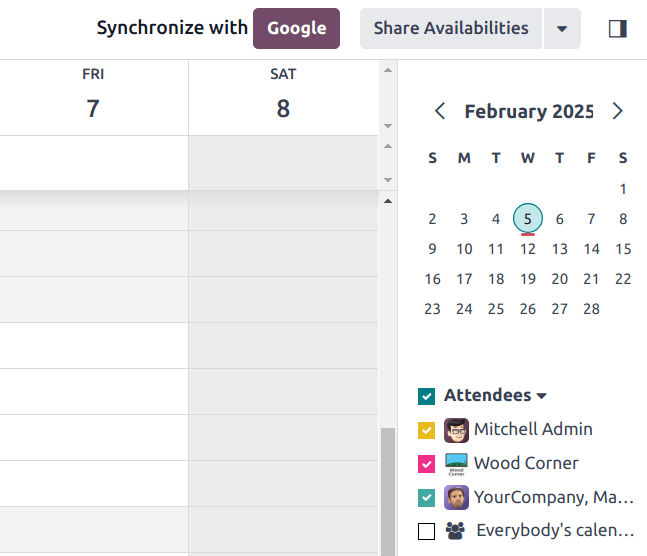

Upon opening the Calendar app, users have an overview of their current meetings. The selected view option appears as a Day, Week, Month, or Year drop-down menu. Under the view options drop-down menu, users can also enable or disable Show weekends.

Tip

Depending on the selected view option, users can click the (left or right arrow) buttons to switch between days, weeks, etc., and switch back to the current day with the Today button.

Sync third-party calendars

Users can sync Odoo with existing Outlook and/or Google calendars, by heading to Calendar app ‣ Configuration ‣ Settings. From here, enter Client ID and Client Secret. There is also an option to pause synchronization by ticking the checkbox, or automating synchronization by keeping it blank.

Once the desired configurations are complete, be sure to click Save before moving on.

Events created in synced calendars automatically appear across the integrated platforms.

See also

Create activities from chatter

Instantly create new meetings anywhere in Odoo through an individual record’s chatter, like in a CRM opportunity card or task in the Projects app.

From the chatter, click on the Activities button. In the Schedule Activity pop-up window, select the desired Activity Type, which populates a set of buttons, depending on the activity.

Activities that involve other schedules, like Meeting or Call for Demo, link to the Calendar app. Select one of these activities to link to the Calendar app, then hit Open Calendar to navigate back to the app. Alternatively, it is also possible to Schedule & Mark as Done to close out the activity, or select Done & Schedule Next to keep the Schedule Activity window open to create another.

See also

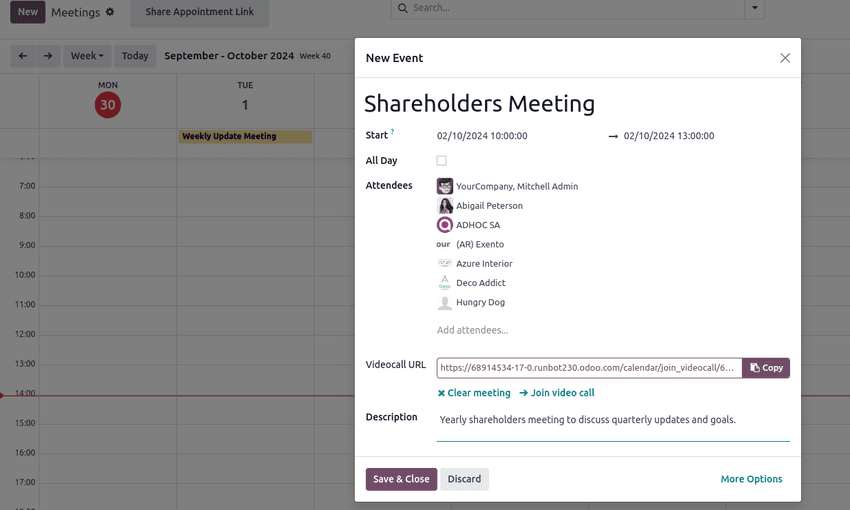

Plan an event

To put an event on the calendar, open the Calendar app, and click into the target date. On the New Event pop-up window that appears, start by adding the event title.

The target date auto-populates in the Start field. This can be changed by clicking into the date section, and selecting a date from the calendar. For multi-day events, select the end date in the second field, then click Apply.

Tick the All Day checkbox if there is no specific start or end time.

For events with specific start and stop times, ensure the All Day checkbox is unticked to enable time selection. With the All Day checkbox unticked, time selections appear in the Start field.

The signed-in user auto-populates as the first attendee. Additional Attendees can be added or created from here, as well.

For virtual meetings, copy and paste the URL into the space provided in the Videocall URL field. Or, click Odoo meeting to create a link.

Next, either create the event by clicking Save & Close, or select More Options to further configure the event.

Tip

Once the event is created, users can click into the virtual meeting directly from the calendar event to access more configuration options.

The Description field allows users to add additional information and details about the meeting.

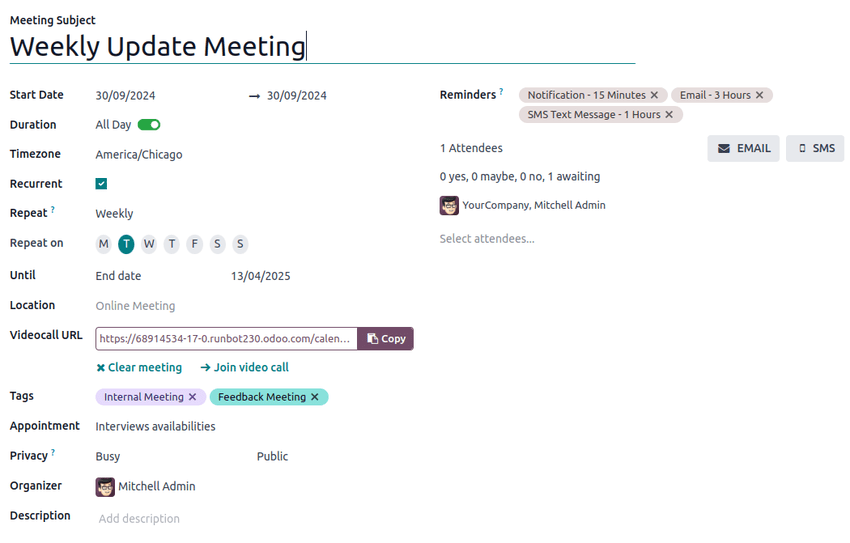

Click More Options to navigate to the meeting form, which provides additional configurations for the event:

- Duration: Define the length of the meeting in hours, or toggle the All Day switch.

- Recurrent: Tick the checkbox to create a recurring meeting. Once selected, this opens new fields:

- Timezone: Select the timezone for which this meeting time is specified.

- Repeat: Select the recurring period of this meeting. Depending on what type of recurrence has been selected, a subsequent field appears, in which users can indicate when the meeting should recur. For example, if Monthly is selected as the Repeat option, a new field appears, in which the user decides on what Day of Month the meeting should recur.

- Until: Select the limited Number of repetitions this meeting should recur, the End date of when the recurrences should stop, or if the meetings should recur Forever.

- Tags: Add tags to the event, like Customer Meeting or Internal Meeting. These can be searched and filtered in the Calendar app when organizing multiple events.

- Appointment: Link existing or new appointments. These can be configured through the Share Availabilities button from the main Calendar dashboard.

- Privacy: Toggle between visibility options to control who can view the event.

- Organizer: This is defaulted to the current Odoo user. Select a new one from existing users, or create and edit a new user.

- Description: Add additional information or details about the meeting.

- Reminders: Select notification options to send to attendees. Choose a default notification, or configure new reminders.

Coordinate with teams’ availability

When scheduling an event for multiple users, on the Calendar app dashboard, tick the checkbox next to Attendees to view team members’ availability. Tick (or untick) the checkbox next to listed users to show (or hide) individual calendars.

Share Availabilities

On the Calendar app main dashboard, click the Share Availabilities button at the top of the page. Next, click and drag to select the available times and dates on the calendar to add them as options in the invitation.

Tip

To remove a selected time range, hover over the availability to click the (trash) icon.

Note

Within the Share Availabilities feature, selecting times is only possible on the Day calendar views.

Once availability has been selected, click the Open button to navigate to the associated appointment.

Several configuration options are available on the appointment form:

In the Scheduling field, set a minimum hour window to ensure appointments are confirmed a specified amount of time in advance. For example, set 01:00 to require attendees to confirm at least one hour before their appointment time.

In the Allow Cancelling field, set a maximum hour window before the appointment that attendees are able to cancel.

The Availability on field enables attendees to book Users or Resources, such as meeting rooms or tables. After selecting Users or Resources, type in the desired user or resource in the space below.

The Front-End Display field is used to choose No Picture or Show Pictures related to the selected user or resource on the appointment page.

If Resources has been selected in the Availability on field, users have an option to Manage Capacities.

Tick the checkbox to limit the maximum amount of people that can use the resource at the same time.

The Assignment Method field enables the order in which attendees book their time and user/resource:

- Pick User/Resource then Time

- Select Time then User/Resource

If Resources has been selected in the Availability On field, a third option is available, Select Time then auto-assign.

Optionally, configure the following tabs:

Click the Preview button to see how the appointment link looks for attendees.

Once the configurations are finished, click the Share button to generate a link to send directly, or click Publish to publish the appointment selection on the connected Odoo website.

Schedule tab

In the Schedule tab of the appointment form, time slots can be managed. The target date and time populate as the first time slots.

To add a new time slot, hit Add a line. Click into the new blank space under the From field, then select and enter the new target start date and time, respectively. Repeat under the new blank space under To to select and enter the new target end date and time.

Options tab

The Options tab provides additional configurations:

- Website: Specify which website this meeting invitation will be published on.

- Timezone: This defaults to the company’s timezone selected in the Settings app. To change the timezone, select the desired option from the drop-down menu.

- Location: Select or create new locations from the drop-down menu. If this field is left empty, the meeting is considered to be taking place online.

- Videoconference Link: Select from Odoo Discuss or Google Meet to include a video conference link in the meeting invitation, or leave it blank to prevent generating a meeting URL.

- Manual Confirmation: Only shown if Resources has been selected in the Availability On field. Tick the checkbox and enter a maximum percentage of the selected resource(s)’ total capacity to create a manual confirmation requirement to finalize the meeting.

- Up-front Payment: Tick the checkbox to require users to pay before confirming their booking. Once this is ticked, a link appears to Configure Payment Providers, which enables online payments.

- Limit to Work Hours: If Users has been selected in the Availability On field, tick the checkbox to limit meeting time slots to the selected users’ working hours.

- Create Opportunities: When this is selected, each scheduled appointment creates a new CRM opportunity.

- Reminders: Add or delete notification reminders in this field. Select the blank space for additional options.

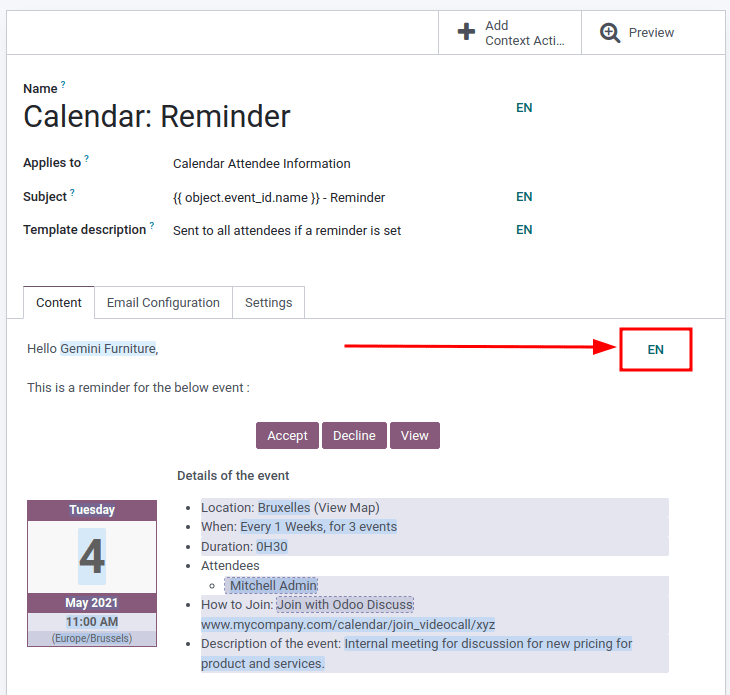

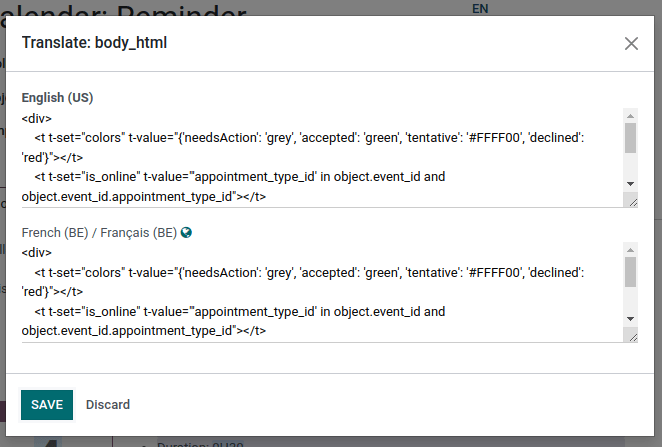

- Confirmation Email: Tick the checkbox to automatically send a confirmation email to attendees once the meeting is confirmed. Select from the email templates or click Search More…, then New to create a custom template.

- Cancelation Email: Tick the checkbox to automatically send a cancelation email to attendees if the meeting is canceled. Select from the email templates or click Search More…, then New to create a custom template.

- CC to: Add contacts to be notified of meeting updates in this field, regardless if they attend the meeting.

- Allow Guests: Tick the checkbox to allow attendees to invite guests.

Questions tab

In the Questions tab, add questions for the attendee to answer when confirming their meeting. Click Add a line to configure a Question. Then select a Question Type, optionally add a Placeholder answer, and choose whether it is a Required Answer.

To learn how to create more comprehensive questionnaires, head to the Survey app documentation on creating and configuring data-capturing questions.

Messages tab

In the Introduction Message field of the Messages tab, add additional meeting information that appears on the invitation.

Information added to the Extra Message on Confirmation field appears once the meeting is confirmed.

On this page

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

Outlook Calendar synchronization

Synchronizing a user’s Outlook Calendar with Odoo is useful for keeping track of tasks and appointments across all related applications.

See also

Microsoft Azure setup

To sync the Outlook Calendar with Odoo’s Calendar, a Microsoft Azure account is required. Creating an account is free for users who have never tried, or paid for, Azure. For more information, view the account options on the Azure website.

Refer to Microsoft’s documentation on how to set up a Microsoft Entra ID (formally called Microsoft Azure Active Directory (Azure AD)). This is an API console to manage and register Microsoft applications.

Existing Microsoft Entra ID users should log in at the Microsoft Azure developer portal. Next, select View under the section labeled Manage Microsoft Entra ID.

Register application

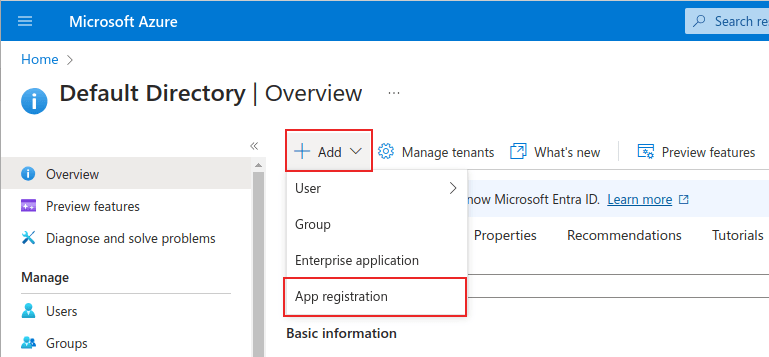

After logging in with the Microsoft Entra ID, register an application.

To create an application, click + Add in the top menu. From the resulting drop-down menu, select App Registration.

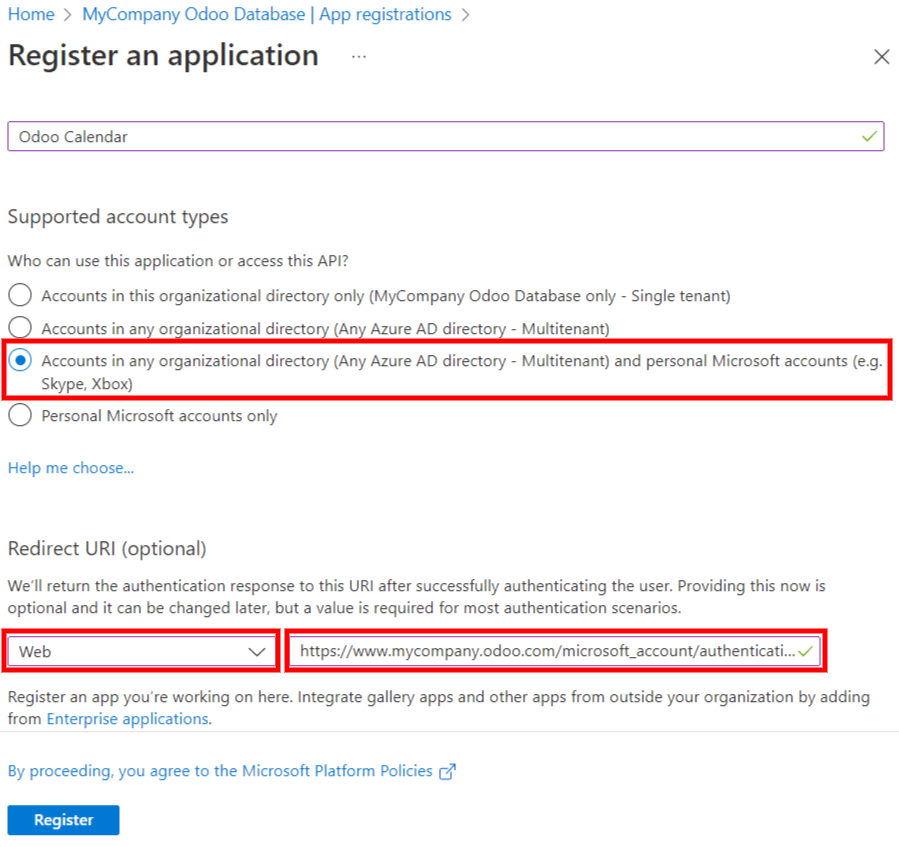

Enter a unique Name for the connected application.

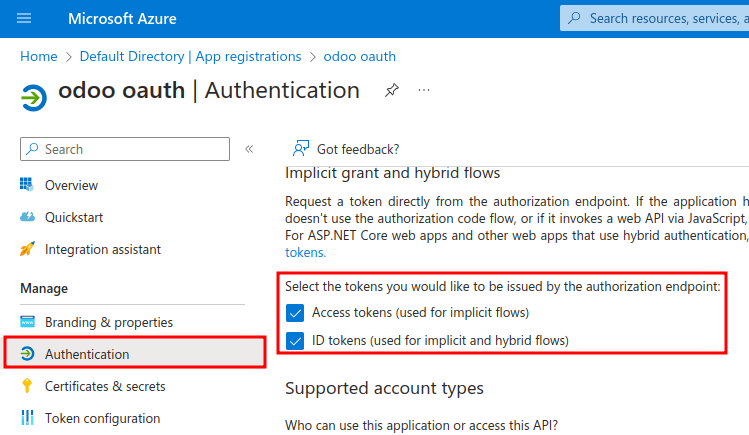

Choosing the appropriate Supported account type is essential, or else the connected application will not work. Users who wish to connect their Outlook Calendar to Odoo should select the Accounts in any organizational directory (Any Microsoft Entra ID directory - Multitenant) and personal Microsoft accounts (e.g. Skype, Xbox) option for Supported account types.

When configuring the Redirect URI, choose the Web option from the first drop-down menu. Then, enter the Odoo database URI (URL) followed by /microsoft_account/authentication.

Example

Enter https://yourdbname.odoo.com/microsoft_account/authentication for the Redirect URI. Replace yourdbname.odoo.com with the URL.

Tip

Ensure the database’s URL (domain) used in the URI is the exact same domain as the one configured on the web.base.url system parameter.

Access the web.base.url by activating developer mode, and navigating to Settings app ‣ Technical header menu ‣ Parameters section ‣ System Parameters. Then, select it from the Key list on the System Parameters page.

For more information on the restrictions and limitations of URIs, check Microsoft’s Redirect URI (reply URL) restrictions and limitations page.

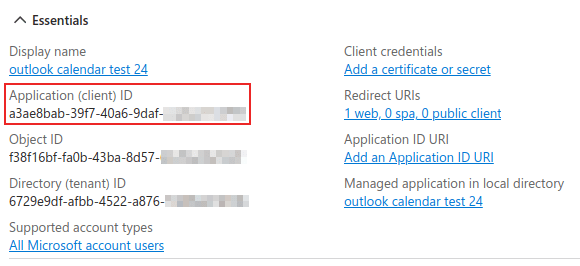

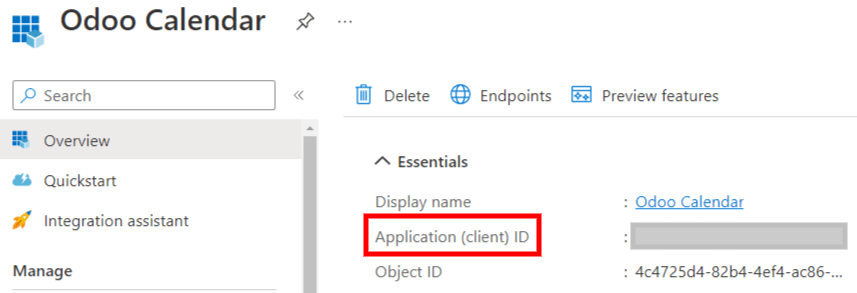

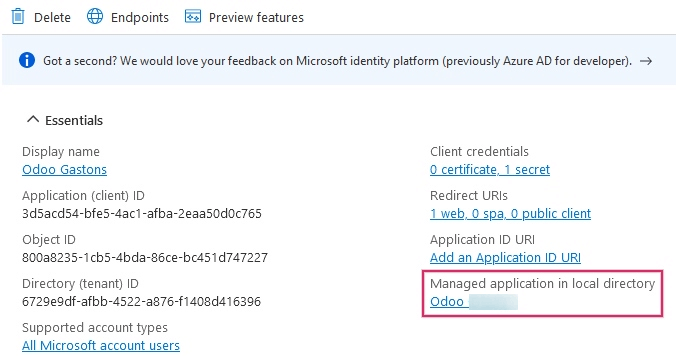

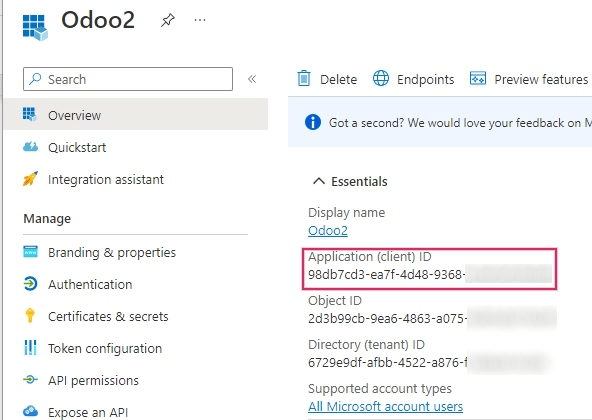

Finally, on the application registration page, click Register button to complete the application registration. The Application (client) ID is produced. Copy this value, as it is needed later, in the Configuration in Odoo.

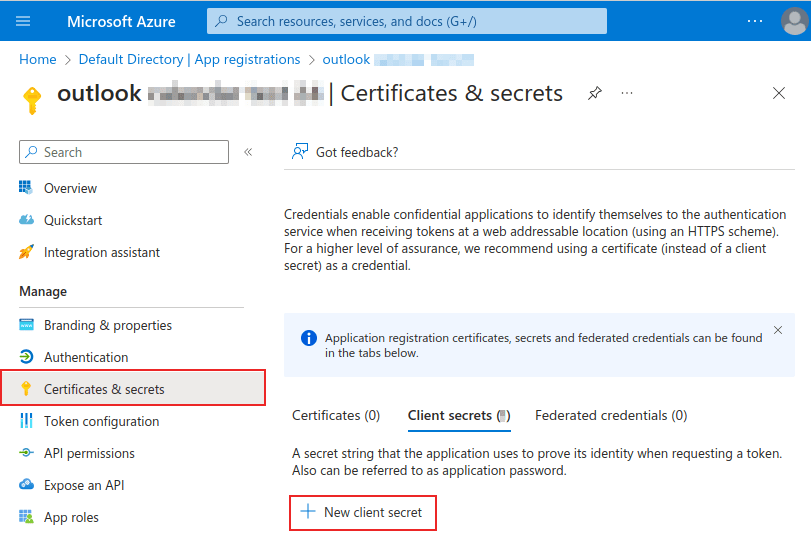

Create client secret

The second credential needed to complete the synchronization of the Microsoft Outlook Calendar is the Client Secret. The user must add a client secret, as this allows Odoo to authenticate itself, requiring no interaction from the user’s side. Certificates are optional.

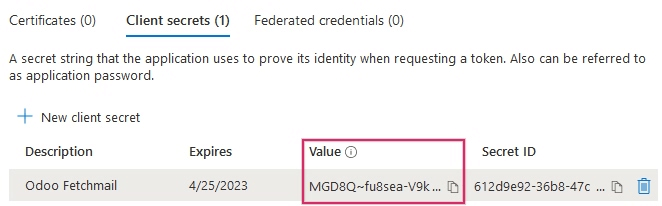

To add a client secret, click Certificates & secrets in the left menu. Then click + New client secret to create the client secret.

Next, type a Description, and select when the client secret Expires. Available options include: 90 days (3 months), 365 days (12 months), 545 days (18 months), 730 days (24 months) or Custom. The Custom option allows the administrator to set a Start and End date.

Finally, click Add to Add a client secret.

Tip

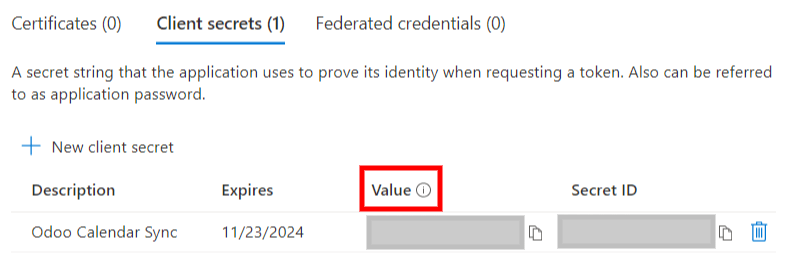

Since resetting the synchronization can be tricky, Odoo recommends setting the maximum allowed expiration date for the client secret (24 months or custom), so there is no need to re-synchronize soon.

Copy the Value for use in the next section.

Warning

Client secret values cannot be viewed, except immediately after creation. Be sure to save the secret when created before leaving the page.

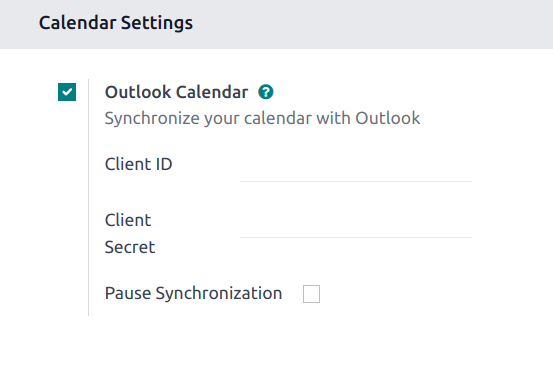

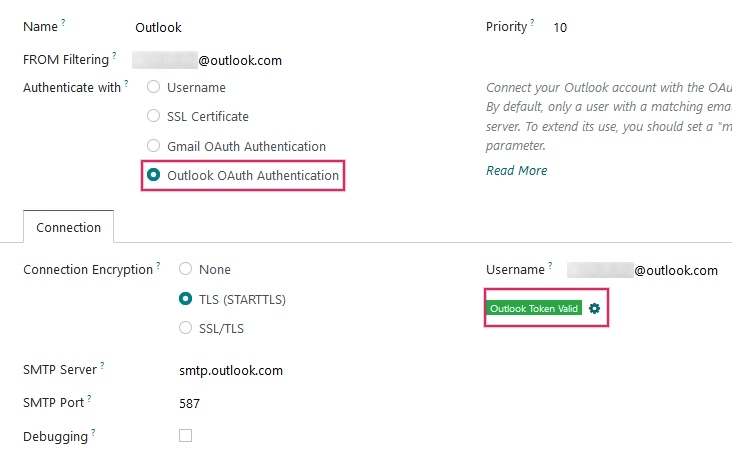

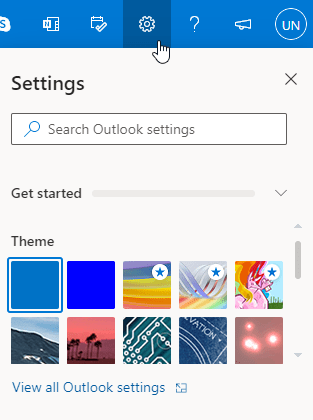

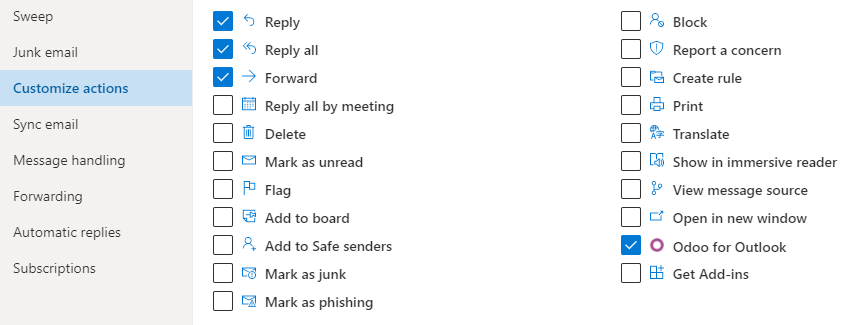

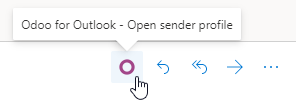

Configuration in Odoo

In the Odoo database, go to Calendar app ‣ Configuration ‣ Settings, and tick the checkbox beside the Outlook Calendar setting. Remember to click Save to implement the changes.

From the Microsoft Azure portal, under the Overview section of the application, copy the Application (Client) ID, if it has not already been copied, and paste it into the Client ID field in Odoo.

Copy the previously-acquired Value (Client Secret Value), and paste it into the Client Secret field in Odoo.

Finally, on the Odoo Settings ‣ General Settings page, click Save.

Sync with Outlook

Warning

Odoo highly recommends testing the Outlook calendar synchronization on a test database and a test email address (that is not used for any other purpose) before attempting to sync the desired Outlook Calendar with the user’s production database.

If the user has any past, present, or future events on their Odoo calendar before syncing their Outlook calendar, Outlook will treat the events pulled from Odoo’s calendar during the sync as new events, causing an email notification to be sent from Outlook to all the event attendees.

To avoid unwanted emails being sent to all past, present, and future event attendees, the user must add the events from the Odoo calendar to the Outlook calendar before the first ever sync, delete the events from Odoo, and then start the sync.

Even after synchronizing the Odoo Calendar with the Outlook calendar, Outlook will still send a notification to all event participants every time an event is edited (created, deleted, unarchived, or event date/time changed), with no exceptions. This is a limitation that cannot be fixed from Odoo’s side.

In summary, once a user synchronizes their Outlook calendar with the Odoo calendar:

- Creating an event in Odoo causes Outlook to send an invitation to all event attendees.

- Deleting an event in Odoo causes Outlook to send a cancellation to all event attendees.

- Unarchiving an event in Odoo causes Outlook to send an invitation to all event attendees.

- Archiving an event in Odoo causes Outlook to send a cancellation to all event attendees.

- Adding a contact to an event causes Outlook to send an invitation to all event attendees.

- Removing a contact from an event causes Outlook to send a cancellation to all event attendees.

Sync Odoo Calendar and Outlook

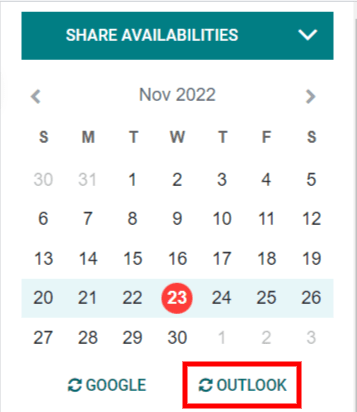

In the Odoo database, open to the Calendar module, and click the Outlook sync button on the right-side of the page, beneath the monthly calendar.

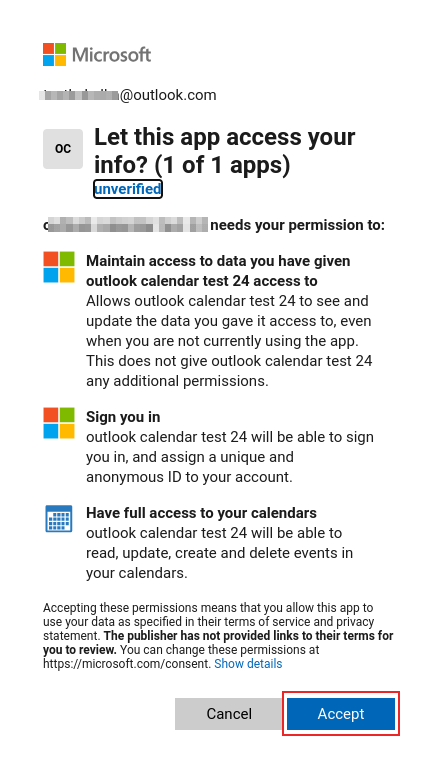

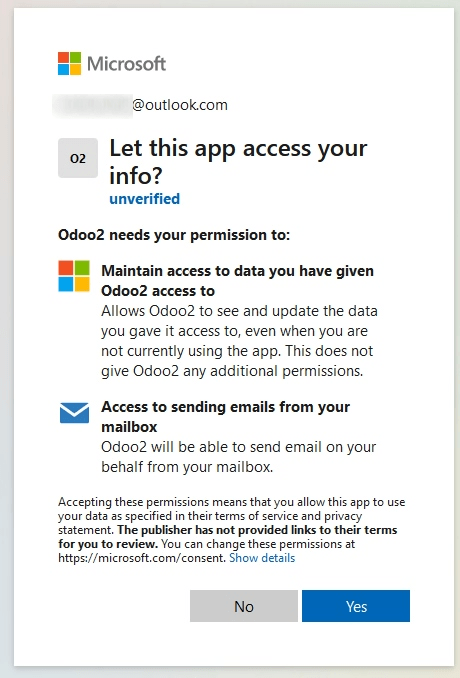

The synchronization is a two-way process, meaning that events are reconciled in both accounts (Outlook and Odoo). The page redirects to a Microsoft login page, and the user is asked to log in to their account, if they are not already. Finally, grant the required permissions by clicking Accept.

Note

All users that want to use the synchronization simply need to sync their calendar with Outlook. The configuration of Microsoft’s Azure account is only done once, as Microsoft Entra ID tenants’ client IDs and client secrets are unique, and help the user manage a specific instance of Microsoft cloud services for internal and external users.

See also

Troubleshoot sync

There may be times when the Microsoft Outlook Calendar account does not sync correctly with Odoo. Sync issues can be seen in the database logs.

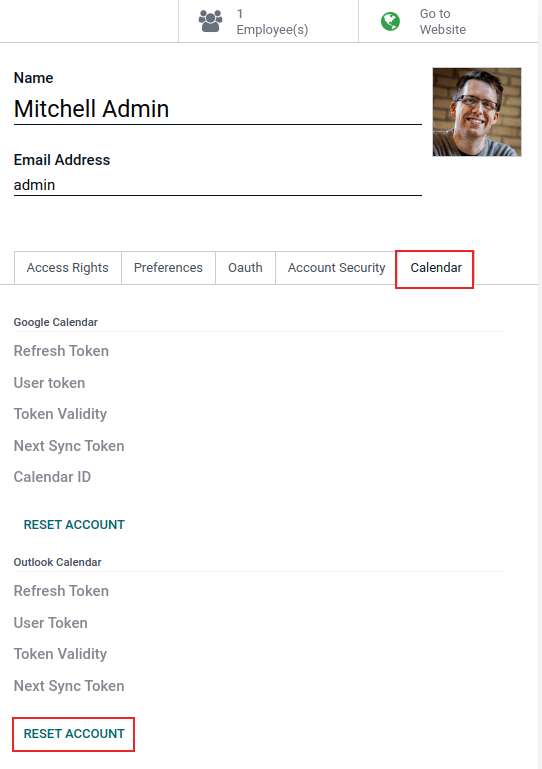

In these cases, the account needs troubleshooting. A reset can be performed using the Reset Account button, which can be accessed by navigating to Settings app ‣ Manage Users. Then, select the user to modify the calendar, and click on the Calendar tab.

Next, click Reset Account under the correct calendar.

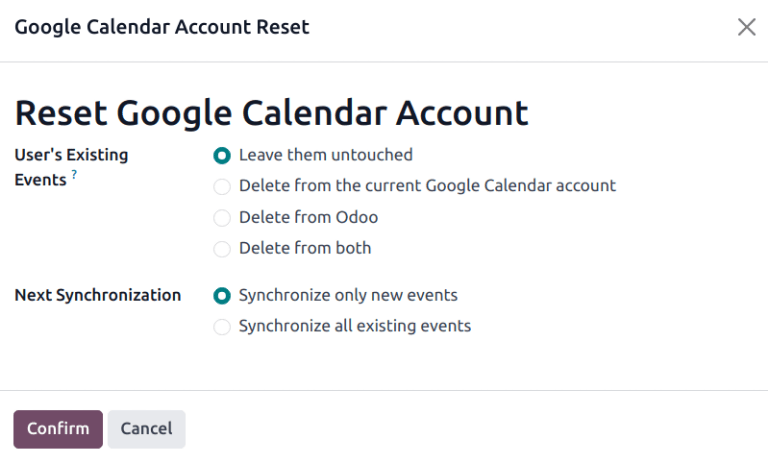

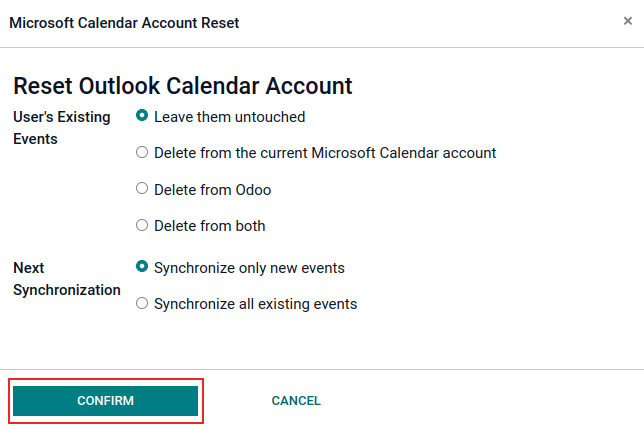

Reset options

The following reset options are available for troubleshooting Microsoft Outlook Calendar sync with Odoo:

User’s Existing Events:

- Leave them untouched: no changes to the events.

- Delete from the current Microsoft Calendar account: delete the events from Microsoft Outlook Calendar.

- Delete from Odoo: delete the events from the Odoo calendar.

- Delete from both: delete the events from both Microsoft Outlook Calendar and Odoo calendar.

Next Synchronization:

- Synchronize only new events: sync new events on Microsoft Outlook Calendar and/or Odoo calendar.

- Synchronize all existing events: sync all events on Microsoft Outlook Calendar and/or Odoo calendar.

Click Confirm after making the selection to modify the user’s events and the calendar synchronization.

On this page

Get Help

Contact Support Ask the Odoo Community

EN

Odoo 18

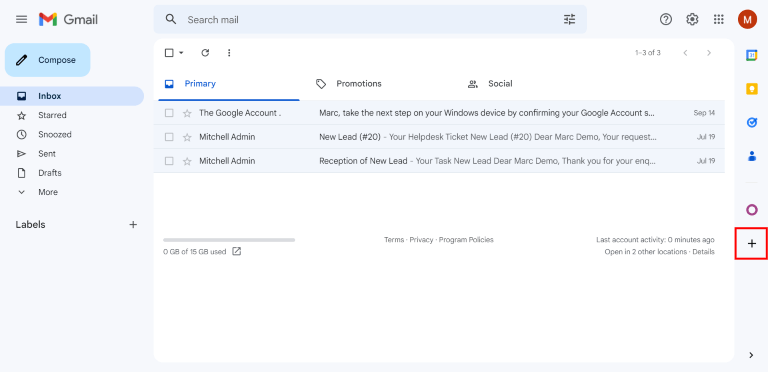

Google Calendar synchronization

Synchronize Google Calendar with Odoo to see and manage meetings from both platforms (updates go in both directions). This integration helps organize schedules, so a meeting is never missed.

See also

Setup in Google

Select (or create) a project

Create a new Google API project and enable the Google Calendar API. First, go to the Google API Console and log into the Google account.

Note

If this is the first time visiting this page, Google will prompt the user to enter a country and agree to the Terms of Service. Select a country from the drop-down list and agree to the ToS.

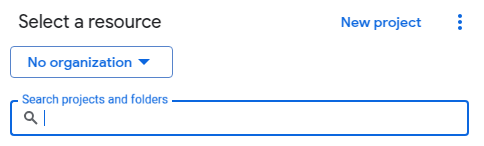

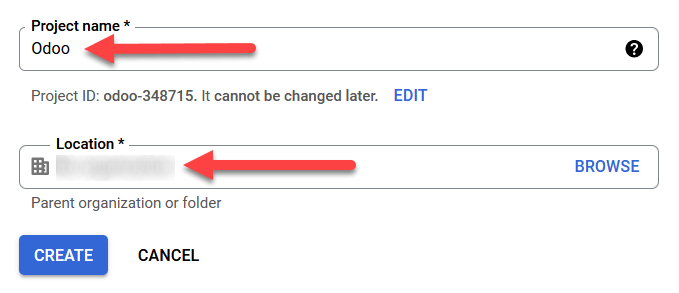

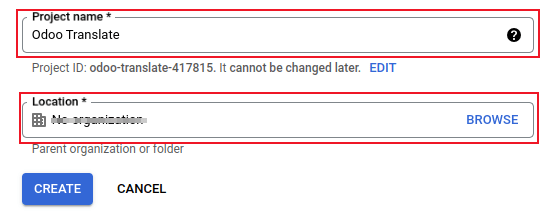

Next, click Select a project and select (or create) an API project to configure OAuth in, and store credentials. Click New Project.

Give the API project a clear name, like Odoo Sync, so it can be identified. Then click the Create button.

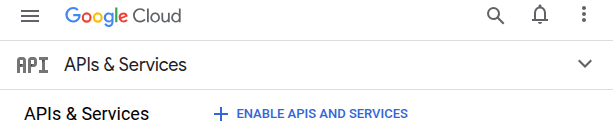

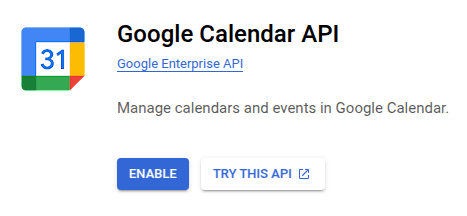

Enable Google calendar API

Now, click on Enabled APIs and Services in the left menu. Select Enabled APIs and Services again if the Search bar does not appear.

After that, search for Google Calendar API using the search bar and select Google Calendar API from the search results. Click Enable.

OAuth consent screen

Now that the API project has been created, OAuth should be configured. To do that, click on OAuth consent screen in the left menu, then click the Get started button.

Warning

Personal Gmail Accounts are only allowed to be External User Type, which means Google may require an approval, or for Scopes to be added on. However, using a Google WorkSpace account allows for Internal User Type to be used.

Note, as well, that while the API connection is in the External testing mode, then no approval is necessary from Google. User limits in this testing mode is set to 100 users.

Follow the proceeding steps, in order:

- In App Information, type Odoo in the App name field, then enter the email address for the User support email field and click the Next button.

- In Audience, select External, then click the Next button.

- In Contact Information, enter the email again, then click the Next button.

- In Finish, tick the checkbox to agree to Google API Services: User Policy. For the last step, click the Create button.

Authorized domain setup

Next, any domains set to appear on the consent screen or in an OAuth client’s configuration must be pre-registered. To do so, navigate to Branding in the left menu. In the Authorized domains section, click the Add domain button to create a field to enter an authorized domain. Enter a domain, such as odoo.com, then click the Save button at the bottom of the page.

Test users

To give users the ability to sync with personal Gmail accounts, they must be set as a test user. Setup test users by going to Audience in the left-side menu and clicking the Add users button in the Test users section. Enter any desired user emails, and click the Save button.

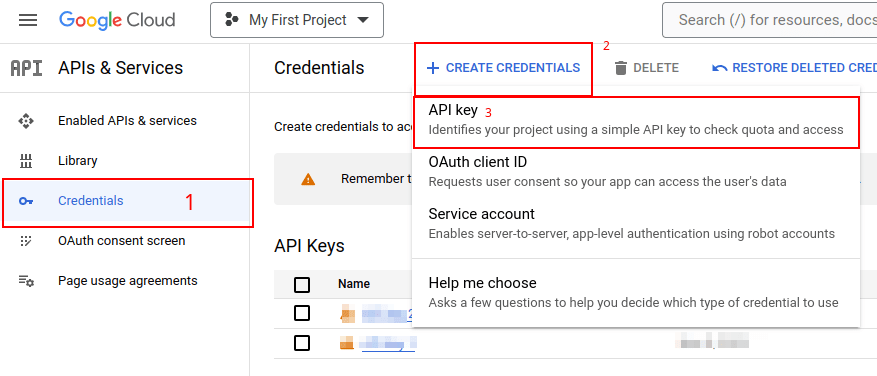

Create credentials

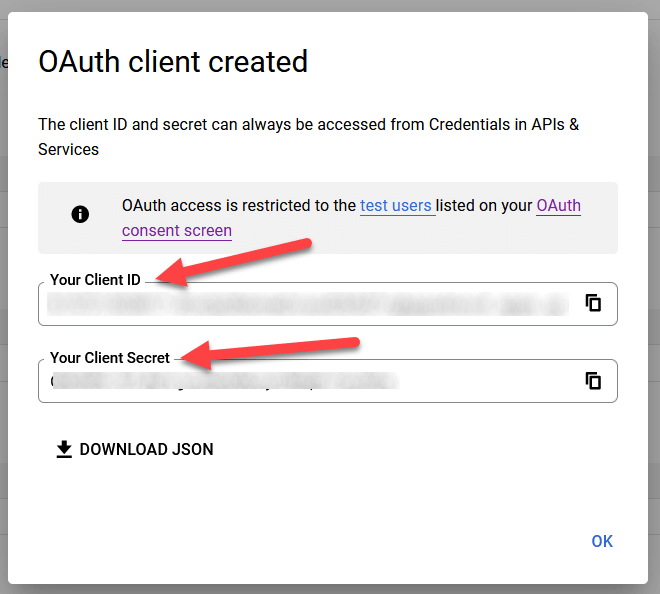

The Client ID and the Client Secret are both needed to connect Google Calendar to Odoo. This is the last step in the Google console. Begin by clicking Clients in the left menu. Then, click Create Credentials, and select OAuth client ID, Google will open a guide to create credentials.

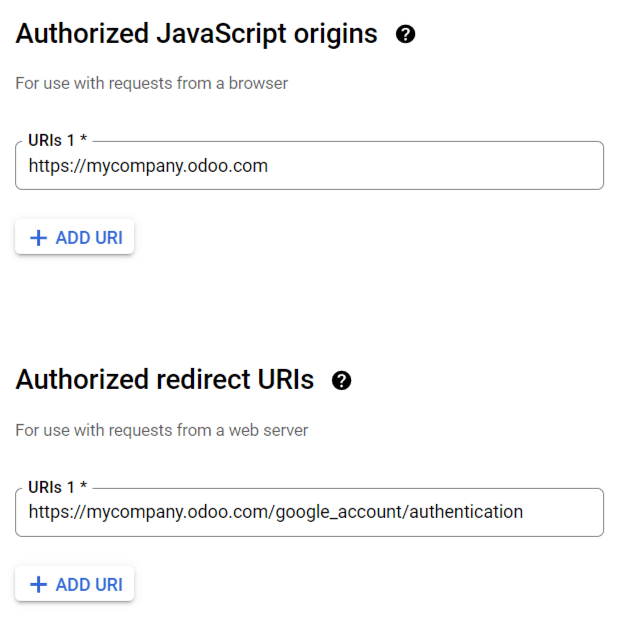

Under Create OAuth Client ID, select Website application for the Application Type field, and type My Odoo Database for the Name.

- Under the Authorized JavaScript Origins section, click + Add URI and type the company’s Odoo full URL address.

- Under the Authorized redirect URIs section, click + Add URI and type the company’s Odoo URL address followed by /google_account/authentication. Finally, click Create.

A Client ID and Client Secret will appear, save these somewhere safe.

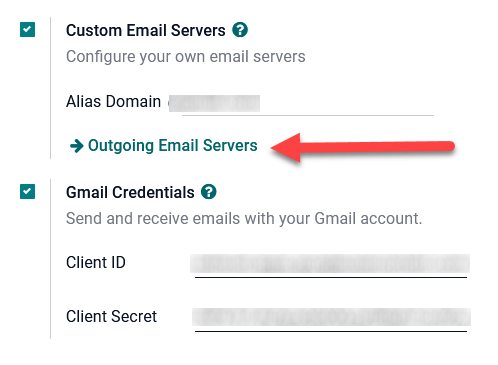

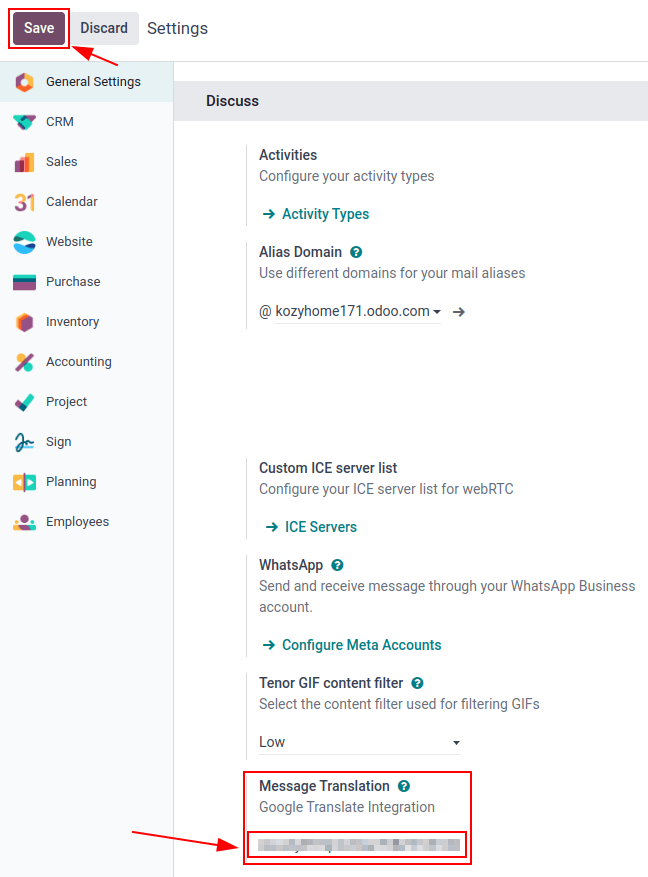

Setup in Odoo

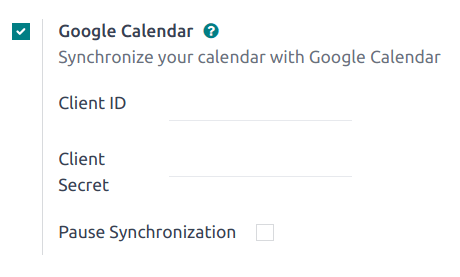

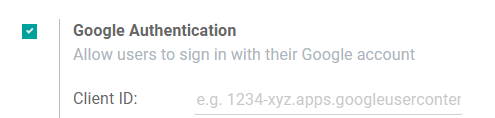

Once the Client ID and the Client Secret are located, open the Odoo database and go to Settings ‣ Calendar to find the Google Calendar feature. Tick the checkbox labeled Google Calendar.

Next, copy and paste the Client ID and the Client Secret from the Google Calendar API credentials page into their respective fields below the Google Calendar checkbox. Then, click Save.

Note

Tick the Pause Synchronization checkbox to temporarily pause events from being updated. This allows for testing and troubleshooting without removing credentials or uninstalling the synchronization. To resume the sync, clear the checkbox and save.

Sync calendar in Odoo

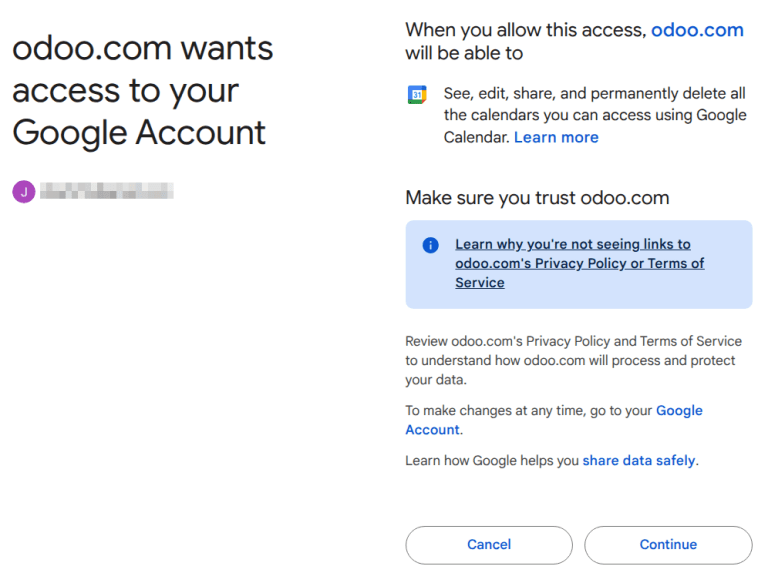

Finally, open the Calendar app in Odoo and click on the Google sync button to sync Google Calendar with Odoo.

Note

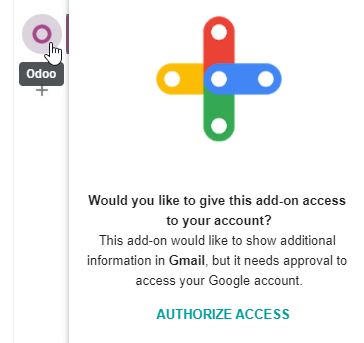

When syncing Google Calendar with Odoo for the first time, the page will redirect to the Google Account. From there, select the Email Account that should have access, then select Continue (should the app be unverified), and finally select Continue (to give permission for the transfer of data).

Now, Odoo Calendar is successfully synced with Google Calendar!

Warning

Odoo highly recommends testing the Google calendar synchronization on a test database and a test email address (that is not used for any other purpose) before attempting to sync the desired Google Calendar with the user’s production database.

Once a user synchronizes their Google calendar with the Odoo calendar:

- Creating an event in Odoo causes Google to send an invitation to all event attendees.

- Deleting an event in Odoo causes Google to send a cancellation to all event attendees.

- Adding a contact to an event causes Google to send an invitation to all event attendees.

- Removing a contact from an event causes Google to send a cancellation to all event attendees.

Events can be created in Google Calendar without sending a notification by selecting Don’t Send when prompted to send invitation emails.

Troubleshoot sync

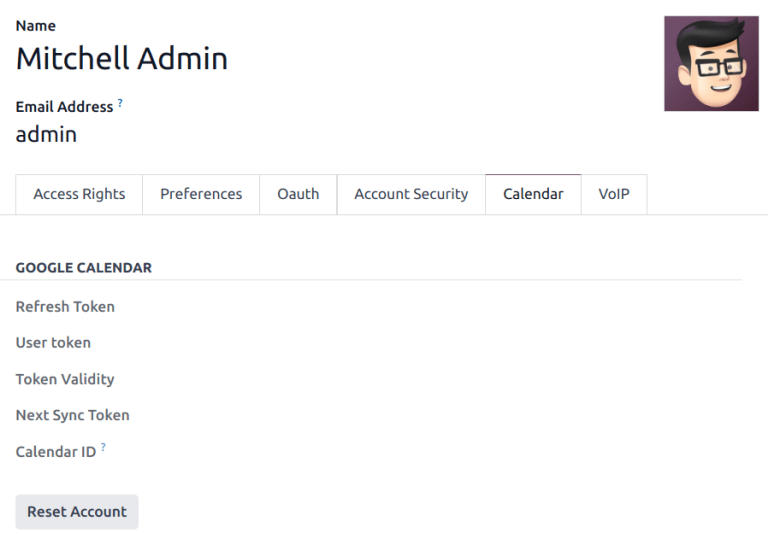

There may be times when the Google Calendar account does not sync correctly with Odoo. Sync issues can be seen in the database logs.

In these cases, the account needs troubleshooting. A reset can be performed using the Reset Account button, which can be accessed by navigating to Settings app ‣ Manage Users. Then, select the user to modify the calendar, and click the Calendar tab.

Next, click Reset Account under the correct calendar.

Reset options

The following reset options are available for troubleshooting Google calendar sync with Odoo:

User’s Existing Events:

- Leave them untouched: no changes to the events.

- Delete from the current Google Calendar account: delete the events from Google Calendar.

- Delete from Odoo: delete the events from the Odoo calendar.

- Delete from both: delete the events from both Google Calendar and Odoo calendar.

Next Synchronization:

- Synchronize only new events: sync new events on Google Calendar and/or Odoo calendar.

- Synchronize all existing events: sync all events on Google Calendar and/or Odoo calendar.

Click Confirm after making the selection to modify the user’s events and the calendar synchronization.

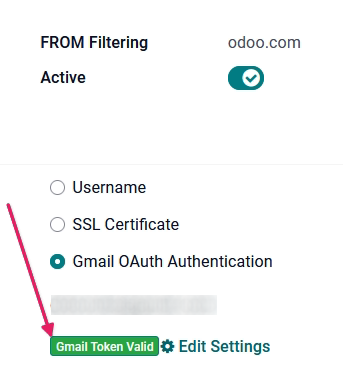

Google OAuth FAQ

At times there can be configuration errors that occur, and troubleshooting is needed to resolve the issue. Below are the most common errors that may occur when configuring the Google Calendar for use with Odoo.

Production vs. testing publishing status

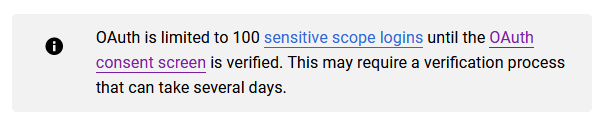

Choosing Production as the Publishing Status (instead of Testing) displays the following warning message:

OAuth is limited to 100 sensitive scope logins until the OAuth consent screen is verified. This may require a verification process that can take several days.

To correct this warning, navigate to the Google API Platform. If the Publishing Status is In Production, click Back to Testing to correct the issue.

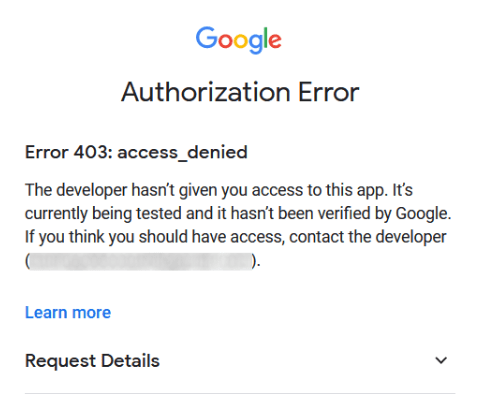

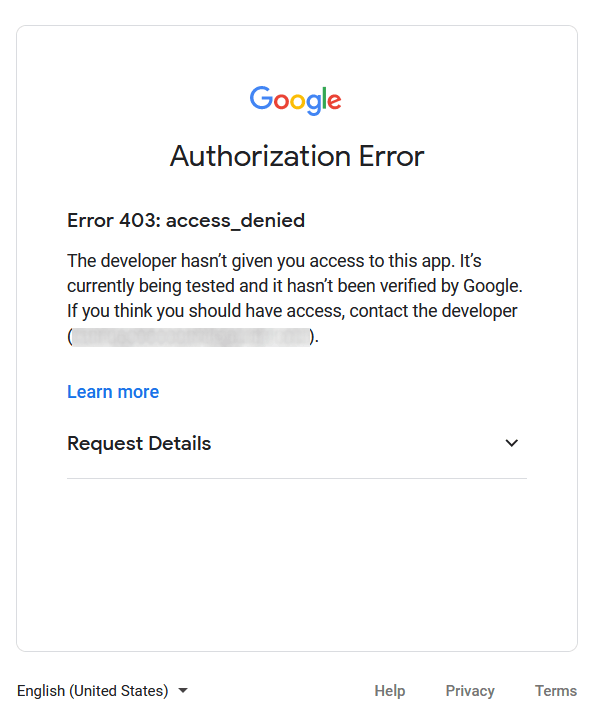

No test users added

If no test users are added to the OAuth consent screen, then an Error 403: access_denied populates.

To correct this error, return to the OAuth consent screen, under APIs & Services, and add test users to the app. Add the email to be configured in Odoo.

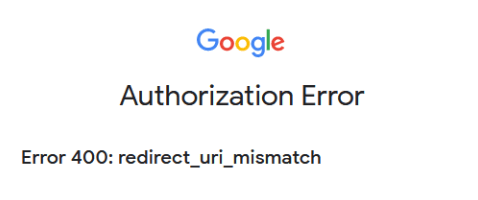

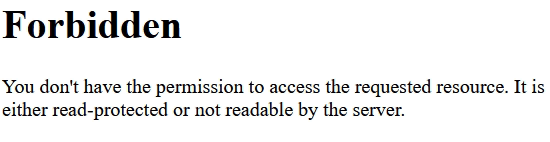

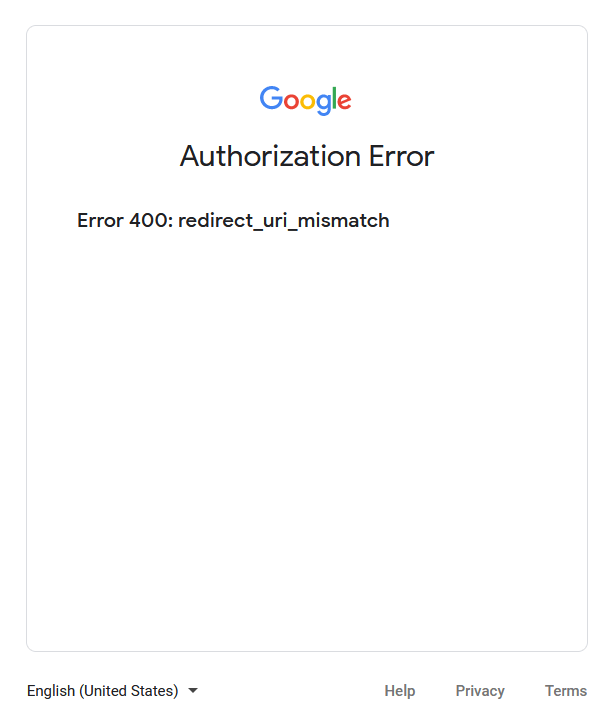

Application Type

When creating the credentials (OAuth Client ID and Client Secret), if Desktop App is selected for the Application Type, an Authorization Error appears (Error 400:redirect_uri_mismatch).

To correct this error, delete the existing credentials, and create new credentials, by selecting Web Application for the Application Type.

Then, under Authorized redirect URIs, click ADD URI, and type: https://yourdbname.odoo.com/google_account/authentication in the field, being sure to replace yourdbname in the URL with the real Odoo database name.

Tip

Ensure that the domain (used in the URI: https://yourdbname.odoo.com/google_account/authentication) is the exact same domain as configured in the web.base.url system parameter.

Access the web.base.url by activating developer mode, and navigating to Settings app ‣ Technical header menu ‣ Parameters section ‣ System Parameters.

On this page

Get Help

Contact Support Ask the Odoo Community

- User Docs

- Database management

- Developer

- Contributing

EN

Odoo 18

Discuss

Odoo Discuss is an internal communication app that allows users to connect through messages, notes, file sharing, and video calls. Discuss enables communication through a persistent chat window that works across applications, or through the dedicated Discuss dashboard.

Upon opening the Discuss app, the Discuss dashboard appears.

Inbox, starred, and history

Upon opening the Discuss app, the Discuss dashboard appears.

On the Discuss dashboard, unread messages are visible in the Inbox. Starred is where starred messages are stored. History shows chatter updates for records in the Odoo database the user has been assigned to, or tagged on.

Direct messages

Direct messages allow the user to communicate privately with one or multiple team members. To start a new direct message, click the icon, next to Direct Messages on the Discuss dashboard, and enter the name of the desired person in the Start a conversation search bar that appears.

Tip

Multiple names can be selected in the Start a conversation search bar. Once all of the names have been entered, press Enter.

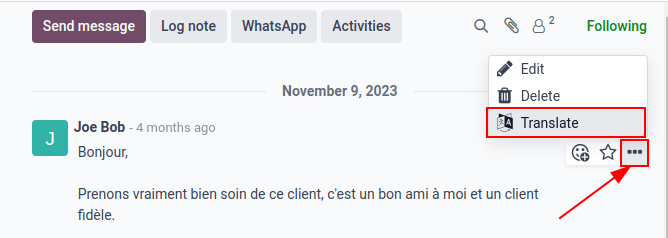

Direct message actions

Hover over a direct message in the chat window to see a menu of actions to take on the message.

- (Add a Reaction): open a drop-down menu of emojis that can be used to react to the direct message.

- (Reply): reply to the direct message in a thread.

- (Mark as Todo): add the message to the Starred tab.

- (Expand): reveals more message actions, including:

- Pin

- Mark as Unread

- Edit

- Delete

Conversation actions

The icons in the top-right corner of a direct message conversation represent different actions the user can take on that conversation.

Click Notification Settings to set up notification preferences for the conversation, or click Start a Call to begin a meeting. See the Meetings section for more information about meetings.

At the top of the direct message window, click the name of the direct message to change the group name, and choose to add a description in the adjacent Add a description field.

Note

The Add a description field is only available for group messages with more than two participants.

User status

It is helpful to see what colleagues are up to, and how quickly they can respond to messages, by checking their status. The status is displayed as a circle in the bottom-right corner of a contact’s photo in the (Members List).

The color of the circle represents the user’s status:

- Green = online

- Orange = away

- White = offline

- Airplane = out of the office

Leave a direct message conversation

To leave a direct message conversations, click the (Leave this channel) icon next to the conversation name in the Direct Messages section of the sidebar.

Note

Leaving a conversation does not delete the direct messages in the conversation. The direct message conversation’s history is visible when another direct message with the same person, or group, is created.

Meetings

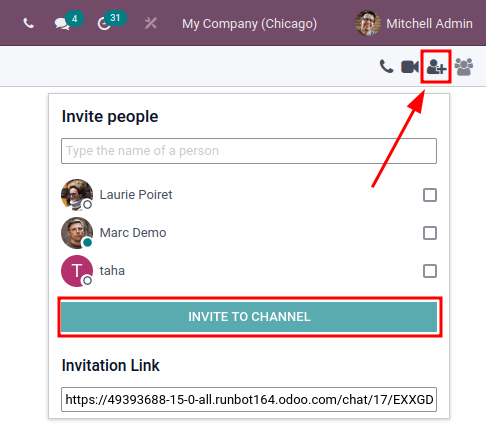

In Discuss, Meetings are video calls. To start a meeting from the Discuss dashboard, click Start a meeting in the top-left corner, and select who to invite to the meeting, via the Invite People drop-down window that appears. To start a meeting from a direct message, click the Start a Call icon in the top-right corner.

Once a meeting has been started, the following buttons can be used:

Icon | Use |

|---|---|

Mute | |

Unmute | |

Deafen | |

Undeafen | |

Turn camera on/off | |

Raise Hand | |

Share Screen | |

Enter Full Screen |

User-specific notification preferences

Access user-specific preferences for the Discuss app by navigating to Settings app ‣ Manage Users, select a user, then click the Preferences tab.

By default, the Notification field is set as Handle by Emails. With this setting enabled, a notification email is sent by Odoo every time a message is sent from the chatter of a record, a note is sent with an @ mention (from the chatter of a record), or a notification is sent for a record the user follows.

By choosing Handle in Odoo, the above notifications are shown in the Discuss app’s Inbox.

Chat from different applications

The Discuss application enables communication across all of Odoo’s applications. To view chats and channels, or start a new message, select the speech bubbles that are consistently present in the upper-right corner of the database header.

See also

Get Help

Contact Support Ask the Odoo Community

- User Docs

- Database management

- Developer

- Contributing

EN

Odoo 18

Use channels for team communication

Use channels in the Odoo Discuss app to organize discussions between individual teams, departments, projects, or any other group that requires regular communication. With channels, employees can communicate inside dedicated spaces within the Odoo database around specific topics, updates, and latest developments having to do with the organization.

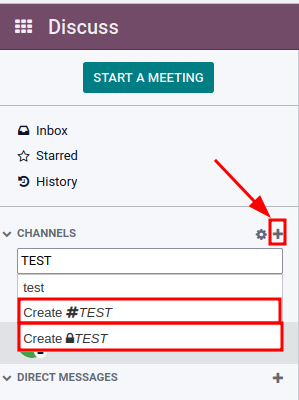

Public and private channels

A Public channel can be seen by everyone, while a Private one is only visible to users invited to it. To create a new channel, navigate to the Discuss app, and then click on the ➕ (plus) icon next to the Channels heading in the left-side menu. After typing the name of the channel, two selectable options will appear: The first is a channel with a hashtag (#) to indicate that it is a public channel; the second option is a channel with a lock icon (🔒) next to it, to indicate that it is a private channel. Select the channel type that best fits the communication needs.

Tip

A public channel is best used when many employees need to access information (such as company announcements), whereas a private channel could be used whenever information should be limited to specific groups (such as a specific department).

Configuration options

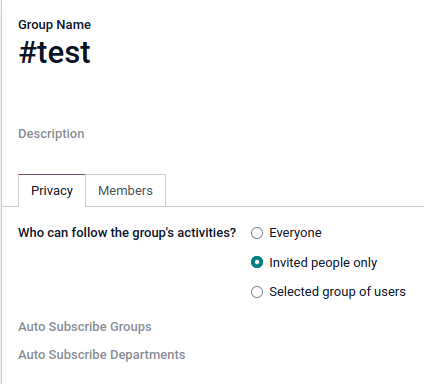

The channel’s Group Name, Description, and Privacy settings can be modified by clicking on the channel’s settings, represented by a ⚙️ (gear) icon in the left sidebar menu, next to the channel’s name.

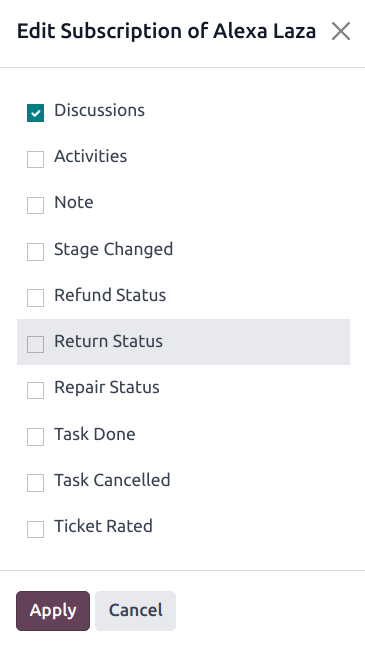

Privacy and Members tabs

Changing Who can follow the group’s activities? controls which groups can have access to the channel.

Note

Allowing Everyone to follow a private channel lets other users view and join it, as they would a public one.

When choosing Invited people only, specify in the Members tab which members should be invited. Inviting members can also be done from the Discuss app’s main dashboard, by selecting the channel, clicking the add user icon in the top-right corner of the dashboard, and finally clicking Invite to Channel once all the users have been added.

When the Selected group of users option is selected, it reveals the ability to add an Authorized Group, along with the options to Auto Subscribe Groups and Auto Subscribe Departments.

The option to Auto Subscribe Groups automatically adds users of that particular user group as followers. In other words, while Authorized Groups limits which users can access the channel, Auto Subscribe Groups automatically adds users as members as long as they are part of a specific user group. The same is true for Auto Subscribe Departments.

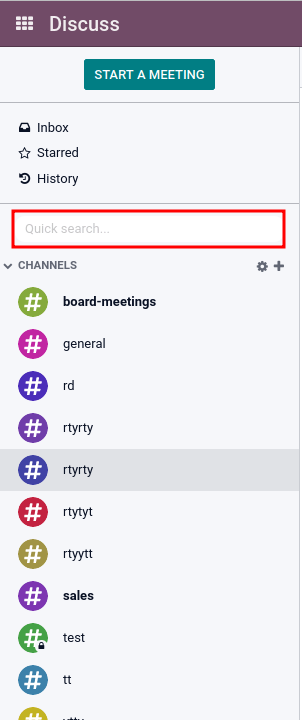

Quick search bar

Once at least 20 channels, direct messages, or live chat conversations (if Live Chat module is installed on the database) are pinned in the sidebar, a Quick search… bar is displayed. This feature is a convenient way to filter conversations and quickly find relevant communications.

Finding channels

Click on the settings ⚙️ (gear) icon, located in the left sidebar, to the right of the CHANNELS collapsible menu item. Doing so will lead to a mosaic view containing all the public channels available. Users can join or leave channels on this screen by clicking the JOIN or LEAVE buttons that appear in the channel boxes.

There is also the ability to apply filtering criteria and save them for later use. The Search… function accepts wildcards by using the underscore character [ _ ], and specific searches can be saved by using the Favorites ‣ Save Current Search drop-down menu.

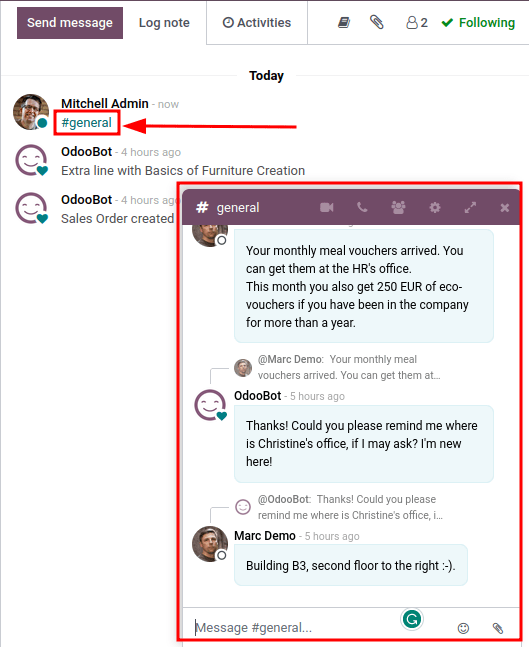

Linking channel in chatter

Channels can be linked in the chatter (log note) of a record in Odoo. To do so, simply type: # and the channel name. Click or press enter on the channel name. Upon logging the note a link to the channel will appear. After clicking on the link a chat window with the channel conversation will pop up in the lower right corner of the screen.

Users are able to contribute to this group channel (either public or member based) by typing messages in window and pressing enter.

See also

On this page

Get Help

Contact Support Ask the Odoo Community

- User Docs

- Database management

- Developer

- Contributing

EN

Odoo 18

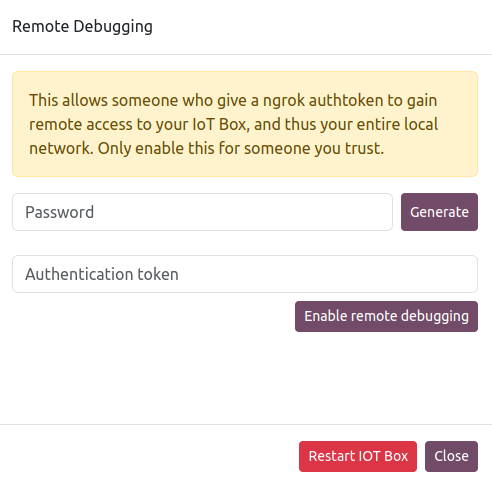

Configure ICE servers with Twilio

Odoo Discuss uses WebRTC API and peer-to-peer connections for voice and video calls. If one of the call attendees is behind a symmetric NAT, you need to configure an ICE server to establish a connection to the call attendee. To set up an ICE server, first, create a Twilio account for video calls, and then, connect that Twilio account to Odoo.

Create a Twilio account

First, go to Twilio and click Sign up to create a new Twilio account. Next, enter your name and email address, create a password, and accept Twilio’s terms of service. Then, click Start your free trial. Verify your email address with Twilio, as per their instructions.

Next, enter your phone number into Twilio. Then, Twilio will send you an SMS text message containing a verification code. Enter the verification code into Twilio to verify your phone number.

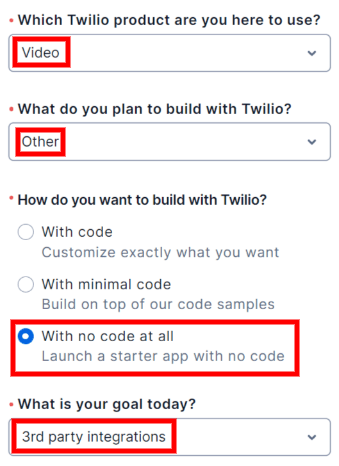

After that, Twilio redirects to a welcome page. Use the following list to answer Twilio’s questions:

- For Which Twilio product are you here to use?, select Video.

- For What do you plan to build with Twilio?, select Other.

- For How do you want to build with Twilio?, select With no code at all.

- For What is your goal today?, select 3rd party integrations.

If necessary, change the billing country. Finally, click Get Started with Twilio.

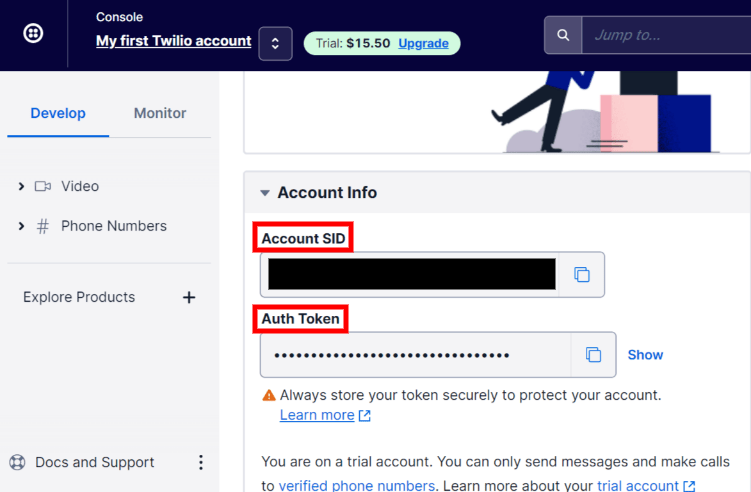

Locate the Twilio Account SID and Auth Token

To locate the Account SID and Auth Token, go to the Twilio account dashboard. Then, click Develop on the sidebar. In the Account Info section, locate the Account SID and the Auth Token. Both of these are needed to connect Twilio to Odoo.

Connect Twilio to Odoo

Open the Odoo database and go to Settings ‣ General Settings ‣ Discuss. Check the box next to Use Twilio ICE servers and enter the Twilio account’s Account SID and Auth Token. Finally, click Save to apply these changes.

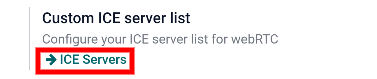

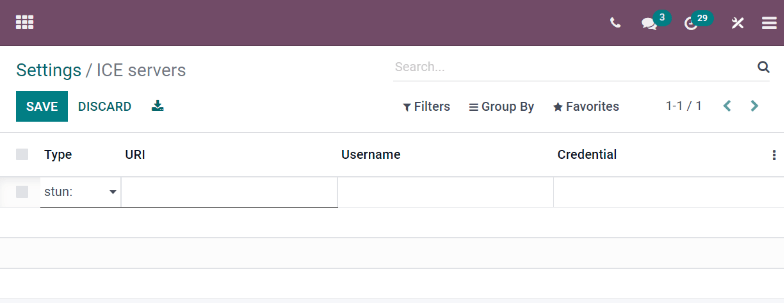

Define a list of custom ICE servers

This step is not required for the Twilio configuration. However, if Twilio is not configured or is not working at any given moment, Odoo will fall back on the custom ICE servers list. The user must define the list of custom ICE servers.

In Settings ‣ General Settings ‣ Discuss, click the ICE Servers button under Custom ICE server list.

Odoo will redirect to the ICE servers page. Here you can define your own list of ICE servers.

Note

For on-premise instances of Odoo, the package python3-gevent is necessary for the Discuss module to run calls/video calls on Ubuntu (Linux) servers.

On this page

Get Help

Contact Support Ask the Odoo Community

- User Docs

- Database management

- Developer

- Contributing

EN

Odoo 18

Chatter

The Chatter feature is integrated throughout Odoo to streamline communication, maintain traceability, and provide accountability among team members. Chatter windows, known as composers, are located on almost every record within the database, and allow users to communicate with both internal users and external contacts.

Chatter composers also enable users to log notes, upload files, and schedule activities.

Chatter thread

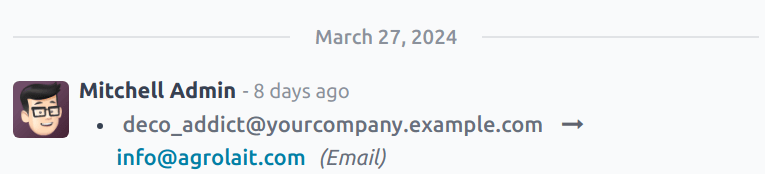

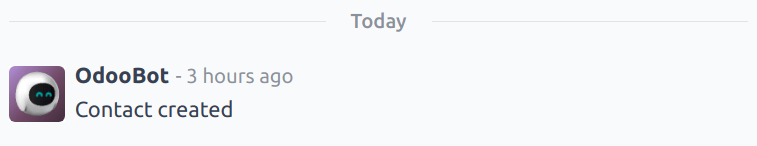

A chatter thread can be found on most pages in the database, and serves as a record of the updates and edits made to a record. A note is logged in the chatter thread when a change is made. The note includes details of the change, and a time stamp.

Example

A user, Mitchell Admin, needs to update the email address of a contact. After they save the changes to the contact record, a note is logged in the chatter of the contact record with the following information:

- The date when the change occurred.

- The email address as it was previously listed.

- The updated email address.

If a record was created, or edited, via an imported file, or was otherwise updated through an intervention by the system, the chatter thread creates a log note, and credits the change to OdooBot.

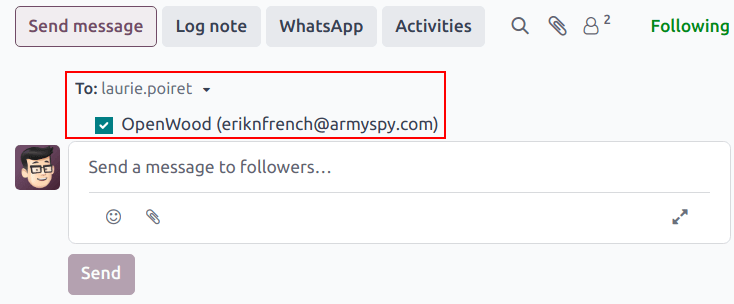

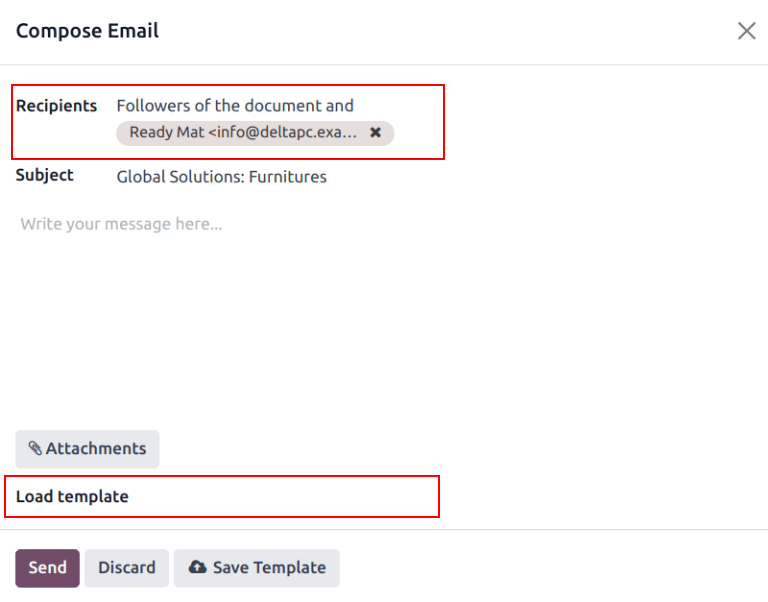

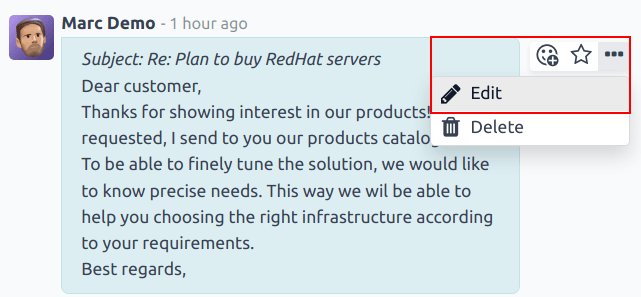

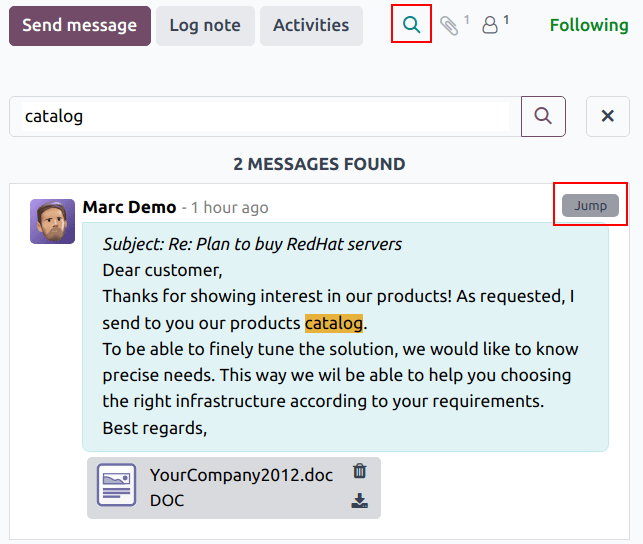

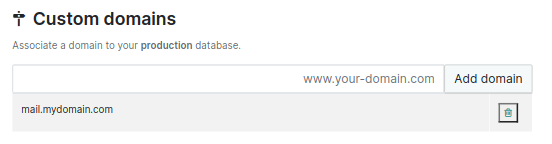

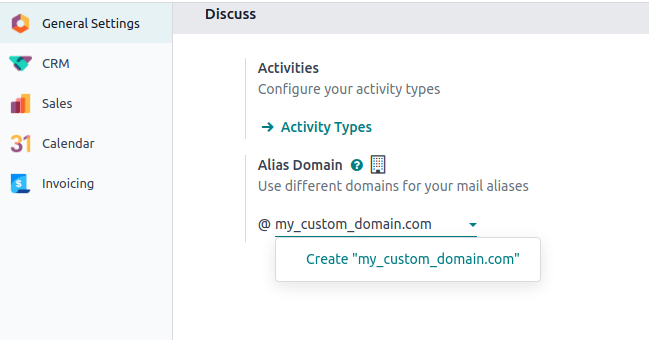

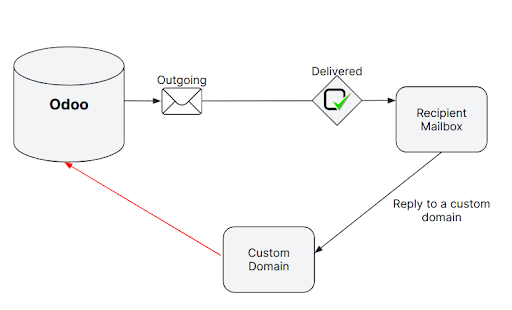

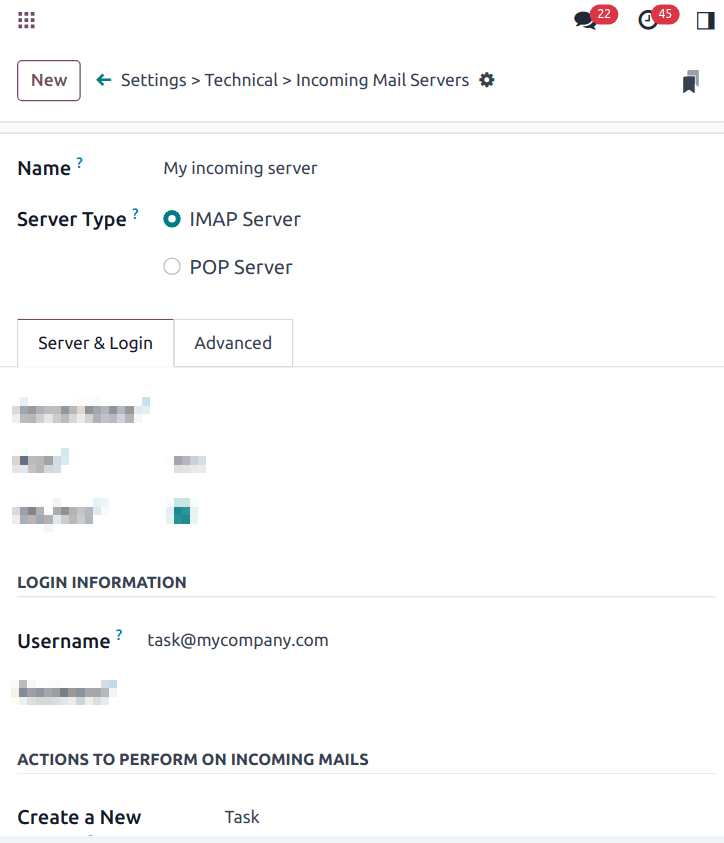

Add followers